E-way bill login is very important to generate an e-way bill online but as new Taxpayers, we don’t know about e waybill login process that how to log in or generate an e-way bill.

Today we are going to learn about the Eway bill login system or e-way login portal where you are to register as a new taxpayer or will have to log in to generate an e-way bill for transportation of goods from one place to another for tracking of goods.

Contents of this post

The facilities available on the E-way bill portal

There are many types of facilities available on the e-way bill portal or site which can be known in two-part as

| 1 | Before Login |

| 2 | After Login |

Before login

First of all type Eway bill login or e way bill portal in the Google search engine and open the first link- ewaybillgst.gov.in

The table of content before the login portal which must be known for using the e-way bill portal

| 1 | Home | Just for the refresh to go home |

| 2 | Laws | Facilities to get knowledge about e waybill Rules Forms Notifications Circulars |

| 3 | Help | Provided help content to generate e waybill User manual CBT FAQS Advertisement Tools |

| 4 | Search | Having facilities to search for important details as Taxpayers Transporters Products & Services Pincode Pin-to-pin distance Notifications search E-way bill print Update block status |

| 5 | Contact us | Just if you have any issue then can contact to help desk |

| 6 | Registration | Most important to register first to get a login E-way bill Registration Enrolment for Transporter E-way bill for citizens |

For a short description, we will study about before login facilities whose table of content is provided above

Home

This is a direct link to get back home when you don’t want to press the back button again and again and it is only for closing all links or windows which have opened and want to close.

Laws

This is a link on the portal for getting knowledge about e-way bill rules, e-way bill forms, e-way bill notifications, and e-way-related circulars which can be helpful to a taxpayer and should be studied if you are new to this.

Help

In this menu, you can search and get help related to the e-way bill user manual in which web system, SMS system, bulk system, and API system. And you can get help such as faqs, advertisements, and tools which will help you in the generation of e-way bills.

Search

This is very important to search for details related to e-way bill and taxpayer which is required to generate an e-way bill and by use of this, you can find these types of details which is available.

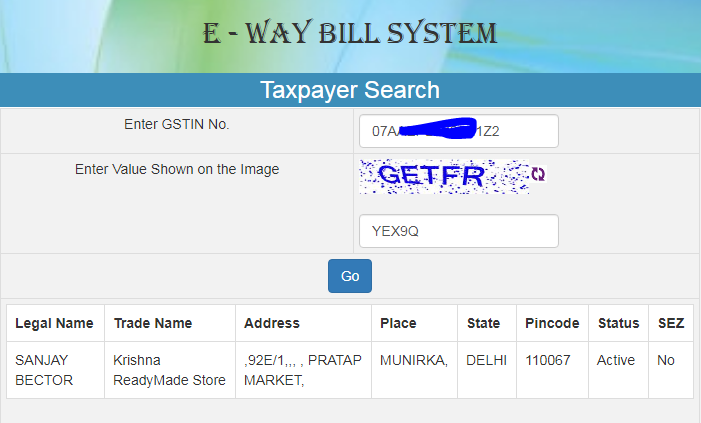

Taxpayers

In this option, you can search any taxpayer detail on the basis of the GSTIN no of a taxpayer.

This is a perfect facility for searching taxpayers’ details such as an address, legal name, trade name, place, state, pin code, and most important GSTIN STATUS which is needed to see before generating an invoice or e-way bill.

So if you want to search for detail of a taxpayer whose GSTIN you have then just take these steps-

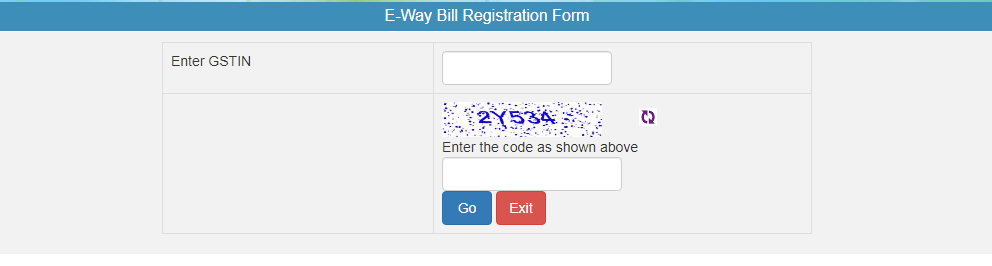

Eway bill portal> Search> Taxpayers> Enter GSTIN> Enter Captcha value shown in picture > submit

And you can see all the detail of searched taxpayers to know taxpayer status.

Transporters

In this option, you can search any taxpayer transporter detail on the basis of GSTIN no of a transporter.

The second option transporter search is also a perfect facility for searching taxpayers’ detail as an address, legal name, trade name, place, state, pin code, and most important GSTIN STATUS which is needed to see before generating an E-way bill.

And we can see whether the transporter is registered on the E-way bill portal or not.

So if you want to search for detail of a transporter whose GSTIN you have then just take these steps-

Eway bill portal> Search> Transporter> Enter GSTIN> Enter Captcha value shown in picture > submit

And you can see all the detail of searched taxpayers to know taxpayer status.

Also, you can see whether GSTIN is registered on the E-way bill portal or not if the transporter is registered on the E-way bill portal then it will be ok.

Products & Services

The third option is provided to the facility of searching for detail of products and services such as HSN code or item detail.

These steps need to search the detail of any item and service from the HSN code to the item description or item description to the HSN code.

Eway bill portal> Search> Product & Services> Enter HSN code or Item description> Enter Captcha value shown in picture > submit

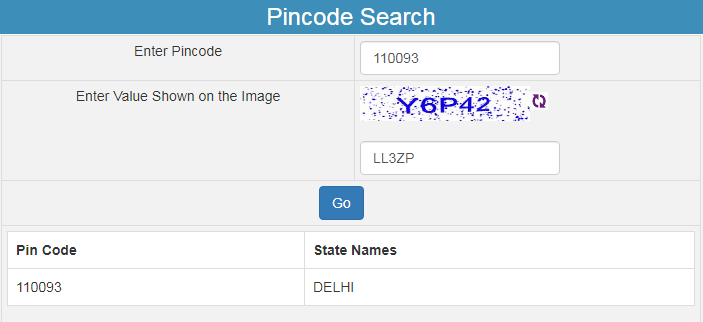

Pin code

The fourth option is provided to search state name through pin code and now the question is how to search

For this just you will have to follow these steps

Eway bill portal> Search> Pin Code> Enter Pin code> Enter Captcha value shown in picture > submit

You will be able to see state names according to the provided pin code.

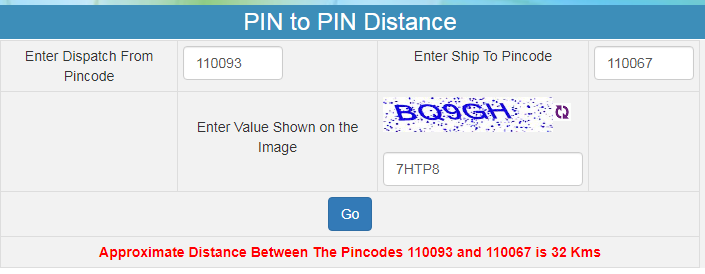

The Pin to pin distance

The next and Fifth option is to search the pin-to-pin distance by just providing pin codes such as

The pin-to-pin distance calculation is very important in the process of generating Eway bills online Because you will have to provide the total distance between the supplier and receiver location to transport goods in Eway bill data.

So we need to know the steps to calculate the pin-to-pin distance facility provided on the e-way bill portal which is as bellow

Eway bill portal> Search> Pin to pin distance> Enter Pin code> Enter Captcha value shown in picture > submit

And after these steps, you will see the calculated distance to update in the E-way bill.

Notifications search

The sixth option is available to provide links to read updated notifications state-wise.

If you want to read any notification of your state then you can follow the steps

Eway bill portal> Search> Notification> Select state

E-way bill print

And the next and seventh options will help to print E-way bills online without login your portal for this you need to enter the detail of already issued E-way bills such as

If you want to print any issued Eway bill then you will have to use these steps

Eway bill portal> Search> E-way bill print> Enter Eway bill no, date, generated by and the document no> Enter Captcha value shown in picture > Go

You will see your Eway bill just take the printout to use.

Update block status

The last option is to update the blocked GSTIN status

The user will be alerted while generating e-waybills in case the entered GSTIN has not filed the returns for the past 2 successive months as this GSTIN will be blocked for the generation of e-way bills.

On the filing of the Return-3B in the GST Common Portal, the block status will get automatically updated as ‘Unblock’ within a day in the e-waybill system.

However, if the status is not updated in the e-way bill system, then the taxpayer can go to the e-waybill portal and go to the option

Search> Update Block Status

Enter the GSTIN

And click on ‘Update GSTIN from Common Portal’.

This will fetch the status of Filing from GST Common Portal and if filed, the status in the e-way bill system will subsequently get updated

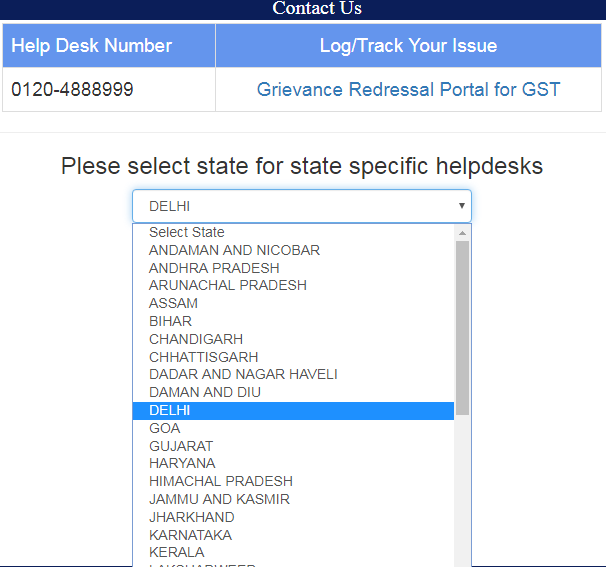

Contact Us

Here you can find all help desks no state-wise and can track grievances or issues as below

It is possible that sometimes you will get some error or issues in the generation of Eway bill online then you want to contact the Eway bill help desk then you should choose this option

Eway will portal> Contact us> select state> help desk no or track grievance

Registration

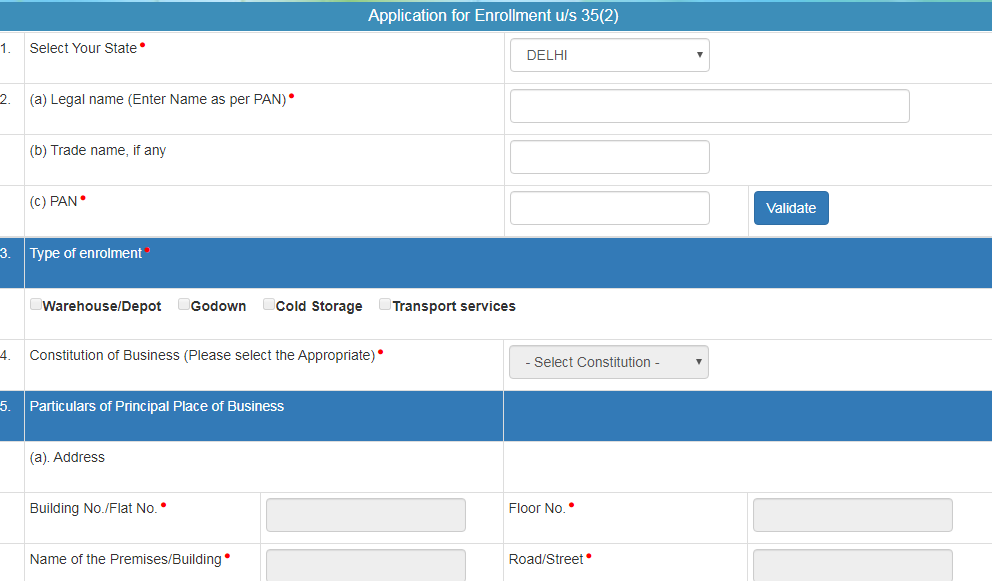

If you are a new taxpayer, transporter, and citizen for the generation of the Eway bill then you will have to register first on the Eway bill portal through this option

And if you want to register yourself on the Eway bill portal then you need to follow these steps

Eway bill portal > Registration>

Then choose your type as

E-way registration

This option is available for the taxpayers who want to generate Eway bills online for the supply of goods from one place to another place.

Enrolment for Transporters

This option is available for the transporters who need to register to generate Eway bills online or for the update of Eway for the transportation of goods through the vehicle.

E way bill for citizens

If you are a citizen of India and want to shift your household items and goods over the limit then you will have to apply an Eway bill online to the transportation of Goods

After login

Secondly, you will have to log in to the e-way bill portal to generate an e-way bill by using the user id or password received after registration on the e-way bill portal with your GSTIN No.

The table of content after the login to use facilities to generate an e-way bill

| 1 | E-waybill | Generate New Generate Bulk Update Part B/ vehicle Update Vehicle- Bulk Change to multivehicle Extend Validity Update EWB transporter Update EWB transporter -bulk Cancel Print EWB |

| 2 | Consolidated EWB | Generate New Generate Bulk Regenerate Print Consolidated EWB |

| 3 | Reject | Reject e-way bill |

| 4 | Reports | My EWB Report Other EWB Report Master Report Summary Report |

| 5 | My Masers | Product Client Suppliers Transporters Bulk Upload |

| 6 | User Management | Create Sub user Freeze sub-user Update sub-user Change Password |

| 7 | Registration | For SMS Mobile GSP API Email Service Common Enrolment |

| 8 | Update | As Transporter/ Taxpayer My GSTIN from CP |

| 9 | Grievance | Detention form (EWP-04) |

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

- Stale cheque meaning, filling, example & benefits

- Self cheque filling, example, features & benefits

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.

One Reply to “E-way bill login: E-way bill login process (updated)”