Bankers Cheque

Normally, It is seen that a cheque issued by a person to someone is a normal cheque which can be identified as one type of cheque. but in some cases, a cheque issued by the bankers to someone else then that cheque is a banker’s cheque.

In simple words, a cheque is a transferable instrument to send and receive money without any physical transfer of cash. Hence cheque writing should be done safely.

So, A banker’s cheque similar to a banker’s draft is guaranteed by the bank. With the help of a banker’s cheque, you can encash or deposit the amount of the cheque up to the validity period of 3 months.

Contents of this post

- What is the Bankers cheque?

- What is the meaning of a Bankers cheque?

- Image of a Bankers cheque

- How can you identify a banker’s cheque?

- What are the features of a Bankers cheque?

- How do you fill out a banker’s cheque?

- How is the banker’s cheque issued by the bank?

- What is the difference between a banker’s cheque and a demand draft?

- Who can withdraw the Bankers cheques?

- How long is a banker’s cheque valid?

- How can I cash my banker’s cheque?

- What are the similarities between a banker’s cheque and a demand draft?

- Faqs on Banker’s cheques

What is the Bankers cheque?

A banker’s cheque is a pay order drawn on the bank’s funds and signed by an authorized officer or a bank manager. A banker’s cheque is a cheque that is issued by the banks when required or demanded. It is similar to a banker’s draft which is guaranteed by the bank. Banker’s cheques are mostly used for making real estate payments, brokerage payments, and institutional payments. The beneficiary needs to deposit a banker’s cheque to the bank to receive the mentioned amount of money.

What is the meaning of a Bankers cheque?

A banker’s Cheque or say pay order is an instrument, generally non-negotiable, issued by the bank on behalf of the customer, containing an order to pay a specified sum to the specified person, in the same city.

A banker’s cheque is a cheque that is issued by the banks when required or demanded. It is similar to a banker’s draft which is guaranteed by the bank. The beneficiary needs to deposit a banker’s cheque to the bank to receive the mentioned amount of money. The cheques are usually cleared one day after the deposit. A banker’s cheque is a pay order drawn on the bank’s own funds and signed by a cashier and a senior executive officer.

Any bank issues it on behalf of the person who holds an account with the bank. The cheque is issued to meet a payment obligation to the beneficiary residing in the same city.

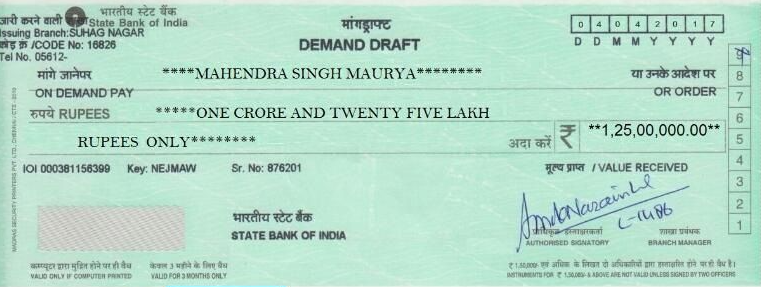

Image of a Bankers cheque

How can you identify a banker’s cheque?

You can identify a cheque as a banker’s cheque when you see the word “Banker’s cheque” on the top middle of the cheque. A banker’s Cheque or say pay order is an instrument, generally non-negotiable, issued by the bank on behalf of the customer, containing an order to pay a specified sum to the specified person, in the same city. You can also identify from the above-shown cheques.

What are the features of a Bankers cheque?

These are the features of the banker’s cheque-

- A banker’s cheque is a pay order drawn on the bank’s funds and signed by the authorized signatories or Branch Manager.

- It is a non-negotiable financial instrument.

- It can be deposited within the validity period of 3 months from the date of the cheque.

- More, It includes the name of the issuing bank along with its location (upper left-hand corner or upper center), the payee’s name, the amount to be tendered (both in alphabets and numbers), and a printed (facsimile) signature of the cashier or senior executive officer of the bank.

- A banker’s cheque cannot be dishonored at all unless it is a fake.

- It is used for payment for settling transactions.

- A banker’s cheque also contains some security features such as a watermark, security thread, color-shifting ink, and special bond paper. All these features make the cheque more secure from counterfeit items.

How do you fill out a banker’s cheque?

A banker’s cheque is issued by the bank only hence it will be printed by the bank officers at the request of any customer. A banker’s Cheque or say pay order is an instrument, generally non-negotiable, issued by the bank on behalf of the customer, containing an order to pay a specified sum to the specified person, in the same city.

How is the banker’s cheque issued by the bank?

A banker’s Cheque or a pay order is an instrument, generally non-negotiable, issued by the bank on behalf of the customer, containing an order to pay a specified sum to the specified person, in the same city.

- Firstly, the bank will be requested by the customer for the banker’s cheque.

- Then the bank will print a banker’s cheque with the requested amount in the name of the requested payee.

- Then Authorised signatory or branch manager will sign.

- The customer will get a banker’s cheque from the bank.

- Then can provide it to the payee.

- Now the payee can deposit it into his bank account.

What is the difference between a banker’s cheque and a demand draft?

| Points | Bankers cheque | Demand draft |

|---|---|---|

| Meaning | Banker’s Cheque or say pay order is an instrument, generally non-negotiable, issued by the bank on behalf of the customer, containing an order to pay a specified sum to the specified person, in the same city. | A demand draft is a financial instrument, used by people for the purpose of transferring money from one place to another. |

| Word written | Bankers Cheque | Demand Draft |

| clearance | It can be cleared in any branch of the same city. | It can be cleared at a branch of the same bank. |

| special feature | All banker’s cheques are pre-printed with “NOT NEGOTIABLE”. | A demand draft of Rs. 20000 or more should be issued with an “A/c payee” crossing. |

Who can withdraw the Bankers cheques?

The person whose name is mentioned over the cheque means the recipient can deposit that cheque into his account by filling out a deposit slip. And make sure it should be presented within the 3 months from the date of the cheque.

How long is a banker’s cheque valid?

Normally, a cheque will be valid for up to three months from the date mentioned in the cheque. Hence after three months from the date on the cheque, it will be invalid and can not be cleared in the account of the named person. whether that cheque is a banker’s cheque.

How can I cash my banker’s cheque?

It can be deposited into the account of the person whose name is mentioned on the cheque and the named person will be able to deposit it into his account.

What are the similarities between a banker’s cheque and a demand draft?

Similarities are-

1. Both are used for payment for settling transactions.

2. Both are paid in advance by the customer.

3. Both of these instruments cannot be dishonored because of the pre-payment clause.

4. Both are used for the transfer of money.

5. Both have a validation period of 3 months.

Faqs on Banker’s cheques

It is not possible to cancel a banker’s cheque.

Yes, the person whose name is mentioned on the cheque can deposit the cheque into his bank account.

No, it can not be endorsed because all banker’s cheques are pre-printed with “NOT NEGOTIABLE”.

Yes, It is safe because the banker’s cheque can be deposited into the account of the named person only. And it can not be endorsed. It can not be dishonored.

Yes, Cash can be withdrawn if that is a banker’s cheque means, the payee of the cheque can present that cheque for encashing in the bank.

A cheque will be a banker’s cheque if it is issued by the bank on behalf of the customer to someone else.

it’s not mandatory to sign behind the cheque.

The charges vary according to the amount of money transfer paid. It can vary from ₹25 for a sum of ₹5000 to ₹50 for an amount that varies between ₹5,000 – ₹10,000.

Yes, there is a difference between the two. A banker’s cheque enables the recipient to encash the cheque in any branch of the bank that has issued it but within the limits of the same city. You can encash a demand draft at any branch of the issuing bank across the country.

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

- Stale cheque meaning, filling, example & benefits

- Self cheque filling, example, features & benefits

- Bankers cheque-One thing you should know

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.