Self-cheque-Normally, It is seen that some Cheque books issued by the bank already have bearer cheques or order cheques. Because you will see a word written on the cheque “or bearer”, “or order”. These words define a cheque as a bearer cheque or an order cheque that can be used for payment to someone but is not safe. These cheques are called Self-cheques when you issue a cheque to yourself by writing the payee’s name as self for withdrawing cash from the bank.

In simple words, a Self-cheque is a cheque that is not crossed and it is a bearer cheque. It is used by the issuer to withdraw money from their bank account.

Contents of this post

- What is a Self cheque?

- Images of a Self cheque

- How can you identify a Self-cheque?

- What are the features of a Self-cheque?

- How should I write a Self cheque?

- What are the simple steps to write a self-cheque?

- What is the difference between a Self-cheque and a crossed cheque?

- Should I give Self-cheque to my suppliers?

- Who can withdraw the Self-cheque?

- How long is a Self-cheque valid?

- Can I withdraw self cheque from any branch?

- How can I cash my Self cheque?

- When a cheque is a Self cheque?

- Faqs on Self cheque

What is a Self cheque?

A Self cheque is basically a cheque issued to the self for withdrawing cash from the bank account. This cheque can be encashed at the cheque issuer bank only. The payee’s name will be written as Self. It is used by the issuer for withdrawing cash from his bank account.

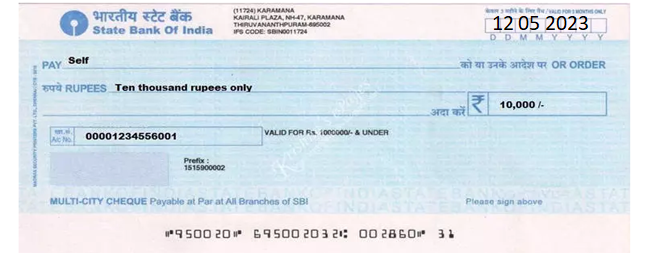

Images of a Self cheque

How can you identify a Self-cheque?

You can identify self-cheques by the word ‘self’ written in the drawee column. Self-cheques can only be drawn at the issuer’s bank.

What are the features of a Self-cheque?

These are the feature of the Self-cheques

- It is a negotiable instrument.

- This cheque may be an “or bearer” or “or order”

- It should be signed on the front and back side.

- It can be encashed by the drawer or anyone who presents a cheque.

- Self cheque is very risky.

- Generally, Identification is not required in a self-cheque.

- It can not be deposited into the bank account. It can be encashed only.

- It must be an uncrossed cheque.

How should I write a Self cheque?

These are the simple steps to know how to write a Self cheque-

- Take a fresh cheque.

- Enter the Date in the right top corner

- Then enter the Recipient Name as Self.

- Fill in the amount in numbers.

- Write the amount in words.

- Sign the cheque.

- And make sure it is a bearer cheque or an order cheque.

What are the simple steps to write a self-cheque?

To write a self cheque in India, you can follow these simple steps:

- First of all, Ensure that you have a bank account in the bank in India and a chequebook associated with that account. Self cheques can only be written from your bank account.

- Now, Take out a blank cheque from your chequebook. Each cheque contains specific fields for filling in the payee’s name, date, amount, and signature.

- Then in the “Pay” or “Pay to the Order of” section, write your name as the payee. You can write “Self” or your name in this space.

- Then, Fill in the date field with the current date on which you are writing the self cheque.

- After that, In the amount section, write the specific amount you wish to withdraw from your bank account in figures. For example, if you want to withdraw Rs. 10,000, write “10,000.00” in this space.

- Then, In the amount section, write out the amount in words. For example, if you wrote “10,000.00” in figures, write “Ten thousand rupees only” in words.

- Then, Sign the cheque at the bottom right-hand corner using the signature you have on file with your bank. Ensure that the signature matches the one you provided during the account opening process.

- After completing the cheque, it’s a good practice to fill in the details on the counterfoil or stub attached to the chequebook. Write down the cheque number, date, amount, and purpose of the cheque for record-keeping.

- Now, Carefully tear out the self cheque along the perforated line, making sure to keep the counterfoil or stub intact for your reference.

- Then, Safely store the self cheque until you are ready to use it. You can deposit it into another bank account under your name or present it to your bank for cash withdrawal.

It’s essential to ensure the security of your cheques and keep them in a safe place to prevent unauthorized access and misuse.

What is the difference between a Self-cheque and a crossed cheque?

| points | Self-cheque | crossed cheque |

|---|---|---|

| Meaning | A self-cheque is one payable to the self or holder who carries and presents the cheque at the bank counter and gets the cash. | A crossed cheque is a cheque payable only in the bank account of the person named on the cheque or endorsed third person. |

| Identification word | A “Self” word in the place of the Payee name. | Two parallel lines on the top left corner or anywhere on the cheque is called crossed cheque. |

| Encashment | Any person can encash the cheque. And any person holding or carrying the cheque. | Only the payee can deposit the cheque into his bank account. No encashment is allowed. |

| Receipt | The recipient’s signature acts as a receipt itself. A drawer signature is also required on the backside of the cheque. | The signature of the payee on the cheque acts as an endorsement only. |

| Banker’s Responsibility for payment of funds to the wrong person | No responsibility of the banker or drawee. | The banker or drawee will be held responsible. |

| Conversion | Self-cheque is not convertible. | Crossed cheque can be converted into an A/c payee cheque. |

Should I give Self-cheque to my suppliers?

If you want to be secure from fraud or misuse of cheques then you should not provide a self-cheque to your suppliers at any time. You should check always the word mentioned over the cheque ” or Bearer” or order and must strike out “or Bearer, or order”. You should always provide an A/c Payee cheque or crossed cheque. You should not provide this cheque because it is used to withdraw cash by yourself or someone else for you.

Who can withdraw the Self-cheque?

These are the persons who can get the amount mentioned over the Self-cheque-

- The drawer himself.

- Or any other person who presents the cheque.

How long is a Self-cheque valid?

Normally, a cheque will be valid up to three months from the date mentioned over the open cheque. Hence after three months from the date on the cheque, it will be invalid and can not be encashed.

Can I withdraw self cheque from any branch?

If any cash transaction, such as a deposit or withdrawal, is done at a non-home branch, a fee is levied. This fee varies across banks. Also, some banks charge even if a third party makes a cash transaction. But now some banks are centralized hence from any branch you can operate your deposit and withdraw.

You should visit your bank branch to withdraw cash by self-cheque.

How can I cash my Self cheque?

If it is a Self-cheque

- You need to visit your branch (in the city) of the bank that the cheque belongs to

- then Present it for encash

- The bank officer, will verify the details on the cheque and encash it for you

- The cheque will be encashed and the person who drawer of the cheque or any third person by authorization will get the cash.

When a cheque is a Self cheque?

A cheque will be a Self-cheque when the word ” self ” is mentioned in the place of the payee’s name in the cheque. And it is not crossed.

Faqs on Self cheque

There are many types of cheques that you need to understand. Here is the link for the different types of cheques provided plz go through and read- the types of cheques

No, the drawer of the cheque or any third person can encash it by visiting the drawer bank branch only. Because this cheque is only for cash withdrawal.

Yes, Self-cheque can be transferred to the third person by simple delivery. The drawer needs to sign the cheque on the backside also if given to any third person for getting cash.

No, It is not safe compared to a crossed or account payee cheque. Because account payee cheques can be deposited into the account of the named person only. And it can not be encashed. But the self-cheque is for withdrawing cash from the bank by himself or any other person.

Yes, Cash can be withdrawn because the Self-check means a cheque issued to self for encashment of the amount from his account.

Most banks in India have set a limit of INR 1 lakh on Cash withdrawal limit from banks per day by cheque. This limit typically applies to self-use or self-addressed cheques.

it’s not mandatory to sign behind the cheque. but may be required by the bank to check the payee’s identity.

You need to write a self-cheque to withdraw cash from your bank account or transfer money to another account you own, such as a savings account.

- How to login Udyam Registration Portal?

- Delhi EWS/DG Admission for 24-25, Eligibility, Dates

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

- Stale cheque meaning, filling, example & benefits

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.