Stale Cheque

Normally, It is seen that some Cheques issued to you or someone else have expired the 3-month validity period. These cheques can be marked as Stale because they can not be encashed or deposited into the bank account.

In simple words, a cheque is a transferable instrument to send and receive money without any physical transfer of cash. Hence cheque writing should be done safely and should be within the prescribed validity period.

Contents of this post

- What is the Stale cheque?

- What is the meaning of a Stale cheque?

- Image of a Stale cheque

- How can you identify a Stale cheque?

- What are the features of a Stale cheque?

- Why should you issue a Stale check?

- What is the remembered point in the case of a stale cheque?

- What is the difference between a Stale cheque and a Post-dated cheque?

- Who can withdraw the Stale cheques?

- How long is a Stale cheque valid?

- Faqs on Stale cheques

What is the Stale cheque?

Many times, A trader used to give a post-dated cheque to their supplier to maintain the money flow in their accounts. But when a cheque is not used within the three-month validity period from the date of the cheque, then it will be called a stale check and it can not be encashed by the bank.

What is the meaning of a Stale cheque?

A stale cheque means a check that is outstanding for more than 3 months from the issue date.

These types of cheques bear a back date of three months before. Even if the bearer presents this cheque to the bank immediately after getting it, the bank will not process the payment on the date of deposit because of the expiry of the validity period. Any cheque stands valid for up to 3 months from the mentioned cheque date.

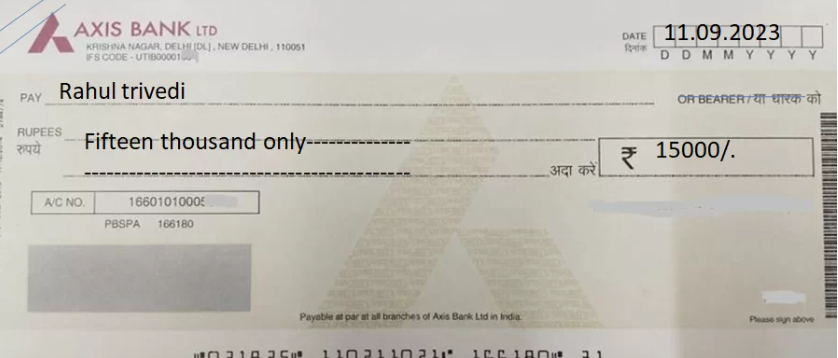

Image of a Stale cheque

How can you identify a Stale cheque?

You can identify a cheque as a stale cheque when you will see a date on the cheque is 3 months before the present date. For example- let’s suppose in the above cheque image, today is date-15.12.2023 but the cheque has a date- of 11.09.2023 then it will be valid for a deposit up to 11.12.2023. Now if you will deposit this on 15.12.2023 on the present date then the bank will not accept it because the expiry of validity means due to a stale.

What are the features of a Stale cheque?

These are the features of the Stale check-

- It is a negotiable instrument.

- It can not be encashed due to a stale check.

- A cheque can be any type of cheque

- You will not see the present date.

- This cheque can be cleared on the date of the cheque or after the date of a cheque for up to 3 months.

Why should you issue a Stale check?

Nobody issues a stale check. It is a situation or term when you can say that this cheque is a stale check. And a check is called stale when it has expired three months from the date of the cheque.

What is the remembered point in the case of a stale cheque?

- A certain date should be mentioned on the cheque.

- Should be filled properly.

- The payee’s name should be mentioned on the cheque.

- It can be more secure by making it a/c payee. the word “A/c Payee” should be mentioned between the two parallel lines.

- Or bearer word should be stricken off.

- And should be present within 3 months from the date of the cheque.

What is the difference between a Stale cheque and a Post-dated cheque?

| points | Stale cheque | Post-dated cheque |

|---|---|---|

| Meaning | A stale cheque is outstanding for more than 3 months from the issue date. | This cheque has a future date. This cheque can be encashed or cleared on the date of the cheque or after the date of the cheque. |

| Identification word | A past date is on the right corner of the cheque. | A future date is on the right corner of the cheque. |

| Clear | It can not be cleared | It can be cleared up to three months from the date of the cheque. |

Who can withdraw the Stale cheques?

Nobody can encash a stale check because of the rule of a 3-month validity period.

How long is a Stale cheque valid?

Normally, a cheque will be valid for up to three months from the date mentioned in the cheque. Hence after three months from the date on the cheque, it will be invalid and can not be cleared in the account of the named person. whether that cheque is post-dated or Anti-dated. Hence stale check is not valid for deposit.

Faqs on Stale cheques

This cheque can be also another type of cheque. There are many types of cheques that you need to understand. Here is the link for the different types of cheques provided plz go through and read- the types of cheques

No, a stale cheque can not be deposited.

Due to an invalid cheque endorsement is not possible.

A stale cheque is an invalid cheque due to the expiry of the validity period.

No, you can not encash a stale cheque.

A cheque will be a Stale cheque after the expiry of 3 months from the cheque date.

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

- Stale cheque meaning, filling, example & benefits

- Self cheque filling, example, features & benefits

- Bankers cheque-One thing you should know

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.