Account Payee Cheque-Normally, It is seen that some Cheque books issued by the bank are already having the bearer cheques or order cheques. Because you will see a word written on the cheque “or bearer”, “or order”. And these words define a cheque as a bearer cheque or an order cheque that can be used for payment to someone but is not safe. And these cheques can be marked as Account Payee cheques for safety purposes by striking out the word ” or bearer and or Order“.

In simple words, a cheque is a transferable instrument to send and receive money without any physical transfer of cash. Hence cheque writing should do safely.

So, With the help of an Account Payee cheque, you can give instructions to pay only in the bank account of the named person.

Contents of this post

- What is the Account Payee cheque?

- What is the meaning of an Account Payee cheque?

- Images of an Account Payee cheque

- How can you identify an Account Payee cheque?

- What are the features of an Account Payee cheque?

- Why should you cross the cheque?

- What is the remembered point while issuing an Account Payee cheque?

- How do you fill an Account Payee cheque?

- What are the types of crossing a cheque?

- What is the difference between an A/c Payee cheque and a crossed cheque?

- Should I give the Account Payee check to my suppliers?

- Who can withdraw the A/c Payee cheques?

- Is the A/c Payee check an open cheque?

- How long is an A/c Payee cheque valid?

- How can I cash my A/c Payee cheque?

- Faqs on Account Payee cheque

What is the Account Payee cheque?

Sometimes, You may see and observe cheques with two sloping parallel lines with the words ‘a/c payee’ written between the lines on the top left corner or anywhere on the cheque. That is an A/c Payee cheque. The lines ensure that irrespective of who presents the cheque, the payment will only be made to the individual bank account whose name is written on the cheque,

in other words, the A/c payee cheque only instructs to transfer to the bank account of the named person only. These cheques are relatively safe because they can not be encashed or transferred to a third person.

What is the meaning of an Account Payee cheque?

An a/c payee cheque means any cheque crossed with two parallel lines on the top left corner or anywhere on the cheque and between the lines ‘A/c Payee” word written which indicates to the bank that this cheque should be cleared only in the bank account of the person whose name is mentioned on the cheque.

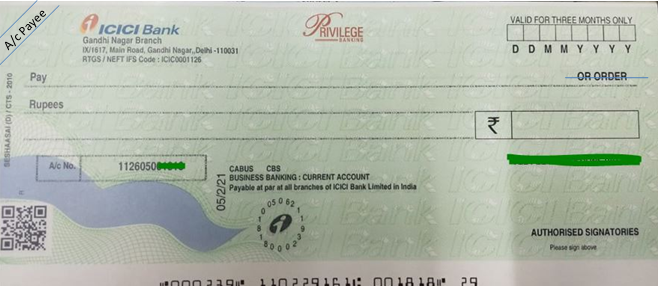

Images of an Account Payee cheque

How can you identify an Account Payee cheque?

You can identify a cheque as an account payee cheque when you see the word “A/c Payee” written between the two parallel lines on the top left corner or anywhere on the cheque as shown in the top left corner with two parallel lines the below image. And the words ‘or order’ and or bearer printed on a cheque should be strikethrough a pen.

What are the features of an Account Payee cheque?

These are the feature of the Account Payee cheques-

- It is a negotiable instrument.

- It can not be encashed by the named person.

- Can not be passed on to another person by endorsement.

- it gives instructions to deposit the amount in the bank account of the named person only.

- Generally, Identification is not required in an A/c payee cheque. Just need to deposit in the payee’s bank account by filing a deposit slip.

Why should you cross the cheque?

You should use the A/c payee cheque for giving payment to someone or your suppliers because it helps-

- To stop encashing the cheque by an unauthorized person.

- Gives instruction to clear the cheque in the account of the named person.

- Records of beneficiaries can be tracked due to payment by an A/c payee cheque.

- And any third person will not be able to misuse it.

What is the remembered point while issuing an Account Payee cheque?

- Should check always whether it is crossed with two parallel lines or not.

- Payee’s name should be mentioned on the cheque.

- It can be more secure by making it a/c payee. the word “A/c Payee” should be mentioned between the two parallel lines.

- Or bearer word should be stricken off.

How do you fill an Account Payee cheque?

These are the steps to fill an A/c payee cheque-

- Take a fresh cheque.

- Enter the Date on the right top corner

- Then enter the Recipient Name.

- Fill the amount in numbers.

- And write the amount in words.

- Sign the cheque.

- End make sure it is not a bearer cheque if the word ‘ or bearer’ is written then it should be strikeout as this “

or bearer“ - And Must be crossed with two parallel lines on the left top corner or anywhere on the cheque.

- and the word “A/c Payee” must be written between the two parallel lines.

What are the types of crossing a cheque?

These are the types of crossing a cheque-

- General crossing

- Account Payee crossing-It is discussed in this post

- Special crossing

- Not negotiable crossing

What is the difference between an A/c Payee cheque and a crossed cheque?

| points | Account Payee cheque | Crossed cheque |

|---|---|---|

| Meaning | A/c Payee cheque is a cheque payable only in the bank account of the person named on the cheque. | A crossed cheque is a cheque payable only in the bank account of the person named on the cheque or endorsed third person. |

| Identification word | A/c payee is written between the two parallel lines on the top left corner or anywhere on the cheque. | Two parallel lines on the top left corner or anywhere on the cheque is called crossed cheque. |

| Transferred through | No endorsement | Proper endorsement |

| Receipt | Not required sign due to no endorsement. | The signature of the payee of the cheque acts as an endorsement only. |

| Conversion | It can not be converted into a crossed cheque. | It can be converted into an A/c payee cheque. |

Should I give the Account Payee check to my suppliers?

If you want to be secure from fraud or misuse of cheques then you should always provide an a/c payee cheque and should not provide a bearer check to your suppliers at any time. You should check always the word mentioned over the cheque ” or Bearer” and must strike out ” or Bearer“. You can provide an order cheque to your suppliers but should also make it an A/c Payee cheque or crossed cheque.

A/c Payee cheque should provide because it instructs the bank to pay only in the a/c of the named person and this is safe for you.

Who can withdraw the A/c Payee cheques?

The person whose name is mentioned over the cheque means the recipient can only deposit that cheque into his account by filling a deposit slip.

Is the A/c Payee check an open cheque?

A cheque is generally known as an Open cheque when it is not crossed whether it is made payable to the bearer or order.

How long is an A/c Payee cheque valid?

Normally, a cheque will be valid for up to three months from the date mentioned in the A/c Payee cheque. Hence after three months from the date on the cheque, it will be invalid and can not be cleared in the account of the named person.

How can I cash my A/c Payee cheque?

The account payee cheque can not be encashed. It can be deposited into the account of the person whose name is mentioned over the cheque and the named person will be able to deposit it into his account only.

Faqs on Account Payee cheque

There are seen many types of cheques which you need to understand. Here is the link for different types of cheques provided plz go through and read- the types of cheques

Yes, the person whose name is mentioned over the cheque can deposit the cheque into his bank account. And this cheque can not be encashed or transferred to a third person.

No.

Yes, It is safe compared to a bearer cheque. Because account payee cheques can be deposited into the account of the named person only. And it can not be encashed.

The drawer of the cheque can cross the cheque as generally or especially to get secure of any fraud. further, a holder of the cheque can also make it crossed if required.

No, Cash can not be withdrawn because the account payee cheque means, the named person can only deposit into his account.

A cheque will be an account payee cheque when the word “A/c Payee is written between the two parallel lines drawn on the cheque. Two parallel lines on the top left corner or anywhere on the cheque will be treated as crossed cheques but after putting the word A/c Payee between the lines, it will be called an account payee cheque.

it’s not mandatory to sign behind the cheque.

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

- Stale cheque meaning, filling, example & benefits

- Self cheque filling, example, features & benefits

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.