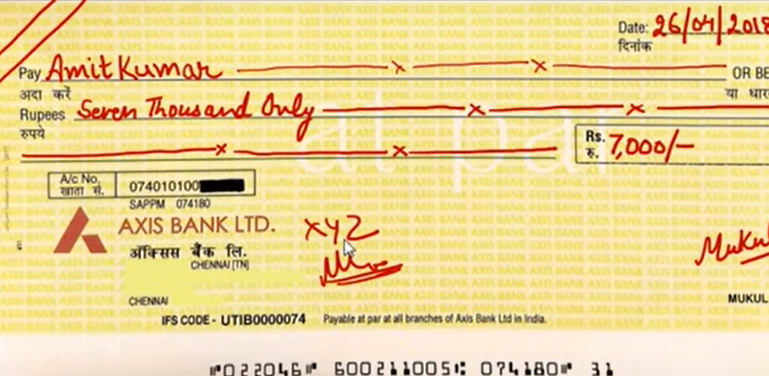

Crossed Cheque-Normally, It is seen that some Cheque books issued by the bank are already having the bearer cheques or order cheques. Because you will see a word written on the cheque “or bearer”, “or order”. And these words define a cheque as a bearer cheque or an order cheque that can be used for payment to someone but is not safe. And these cheques can be marked as crossed cheques for safety purposes by striking out the word ” or bearer and or Order“.

In simple words, a cheque is a transferable instrument to send and receive money without any physical transfer of cash. Hence cheque writing should do safely.

Contents of this post

- What is the Crossed cheque?

- What is the meaning of crossed cheque?

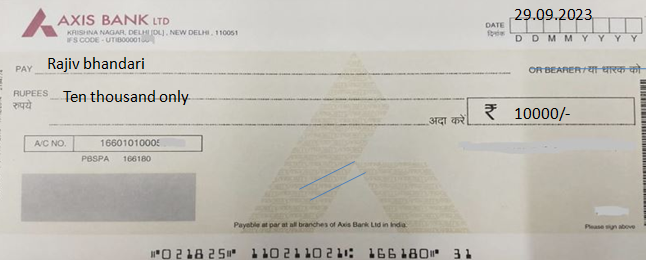

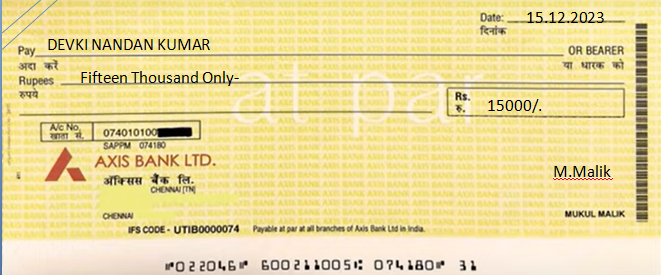

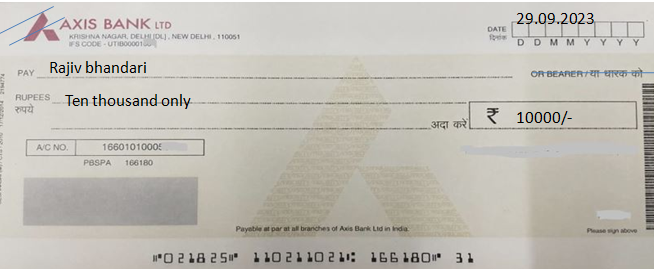

- Images of a Crossed cheque

- How can you identify a Crossed cheque?

- What are the features of a Crossed cheque?

- Why should you cross the cheque?

- What is the remembered point while issuing a Crossed cheque?

- How do you fill a Crossed cheque?

- What are the types of crossing a cheque?

- What is the difference between a Crossed cheque and an Account Payee cheque?

- Should I give the Crossed check to my suppliers?

- Who can withdraw the Crossed cheques?

- Is the Crossed check an open cheque?

- How long is a Crossed cheque valid?

- How can I cash my Crossed cheque?

- Faqs on Crossed check

What is the Crossed cheque?

Sometimes, You may see and observe cheques with two sloping parallel lines with the words ‘a/c payee’ or without any word written on the top left corner of the cheque. That is a crossed cheque. The lines ensure that irrespective of who presents the cheque, the payment will only be made to the individual whose name is written on the cheque, in other words, The crossed cheque instructs the bank to pay only in the account of the named person or the third person by endorsement. These cheques are relatively safe because they can be encashed only at the drawee’s bank.