Bearer Cheque-Normally, It is seen that a Cheque book issued by the bank is having the bearer cheques. Because you will see a word written on the cheque “or Bearer”. And this word defines a cheque as a bearer check which can be converted into other types of cheques by striking out the word ” or Bearer“.

But you will see a word written on the cheque ” or order” in some other Cheque books. In this case, you can make these cheques as bearers by striking out the word “order” and by writing the word “bearer” at the place of order.

Contents of this post

- What is the bearer cheque?

- Images of a bearer check

- How can you identify a bearer check?

- What are the features of a bearer cheque?

- What are the remember point while issuing a bearer cheque?

- How do you fill a bearer cheque?

- What is the difference between a bearer cheque and an order cheque?

- Should I give bearer cheques to my suppliers?

- Who can withdraw the bearer cheques?

- Is the bearer cheque an open cheque?

- How long is a bearer cheque valid?

- How can I cash my bearer’s check?

- Faqs on bearer cheque

What is the bearer cheque?

A bearer cheque is the one in which the payment is made to the person bearing or carrying the cheques. These cheques are transferable by delivery, that is, if you are carrying the cheque to the bank, you can be issued the payment. The banks need no other authorization from the issuer to be allowed to make the payment.

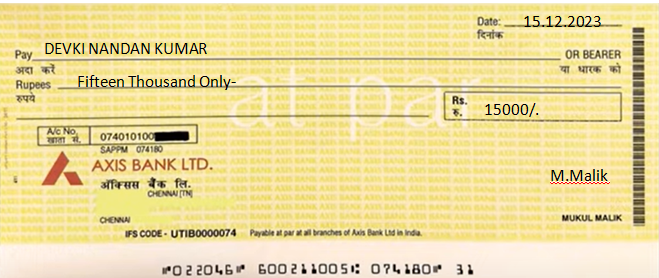

Images of a bearer check

How can you identify a bearer check?

You can identify a check as a bearer check when you see the words ‘or bearer’ printed on cheques.

What are the features of a bearer cheque?

These are the feature of the bearer cheques-

- It is a negotiable instrument.

- Must mention the word “or bearer”

- It can be encashed by the named person or anyone who presents a cheque.

- Can be passed onto another person by mere delivery.

- It is risky to provide a bearer check.

- Generally, Identification is not required in a bearer check.

- Endorsement is not required.

- It can be deposited into the named bank account or can be cashed.

- A bearer check is also called an open check.

What are the remember point while issuing a bearer cheque?

- Though there is no rule of taking the signature of the holder of the cheque at the time of its encashment. But for safety purposes, the bank asks the bearer to sign at the back of the check in the presence of the cashier. This is to confirm the receipt of the funds from the bank.

- Further, the paying cashier does not need to take many precautions to decide the faithfulness of the payee’s ownership. Nevertheless, the bank doesn’t ask for identification proof of the bearer, but when the amount is substantial, the bank may ask for identification proof.

- The transfer of such cheques takes place through simple delivery. This means that if you take the cheque to the bank, the bank issues payment to you against the cheque. Further, no additional authorization from the issuer is necessary in this case.

- If a person with a bearer check of an amount of ₹ 50,000, the bank has to authenticate the identity of the person and ask for proof of address. The bank has every right to first check the details, and once verified, it can make the payment to the person.

- In case a bank finds something amiss, the bank can demand that the account holder, i.e. the issuer of the said cheque, visits the bank in person as well.

- A Know Your Customer (KYC) verification process becomes mandatory if the amount on a bearer check is more than ₹ 50,000

- If a bank suspects the bearer of the cheque who may consistently request immediate cash payment, the bank manager can intervene. The bank manager can contact the account holder and describe the situation. If the account holder sanctions authority, the bank manager asks the concerned bank personnel to clear the bearer cheque.

- A bank cannot deny the payment of the amount on a bearer cheque to the person who presents it. If required, the bank can ask the bearer of the cheque to sign on the rear side of the cheque

How do you fill a bearer cheque?

These are the steps to fill a bearer cheque-

- Take a fresh cheque.

- Enter the Date on the right top corner

- Then enter the Recipient Name.

- Fill the amount in numbers.

- And write the amount in words.

- Sign the cheque.

- End make sure it is a bearer check- should be written ‘or bearer’ if not mentioned.

What is the difference between a bearer cheque and an order cheque?

| points | Bearer cheque | Order cheque |

|---|---|---|

| Meaning | Bearer Cheque is the one payable to the bearer, i.e. holder who carries and presents the cheque at the bank counter gets the payment. | An order cheque is a cheque payable when the only person named on the cheque presents it at the counter of the bank. |

| Identification word | At the end of the name of the payee, you will find the word ‘bearer’ on it. | At the end of the name of the payee, you will find the word ‘order’ on it. |

| Encashment | Any person can encash the cheque by any person holding or carrying the cheque. | Only payee or as per his order the cheque can be encashed. |

| Transferred through | Simple delivery | Proper endorsement |

| Receipt | The recipient’s signature acts as a receipt itself. | The signature of the payee of the cheque acts as an endorsement only. |

| Banker’s Responsibility for payment of funds to the wrong person | No responsibility of the banker or drawee. | Banker or drawee will be held responsible. |

| Conversion | The drawer can convert a bearer cheque into an order one. | The drawer cannot convert an order cheque into a bearer one. |

Should I give bearer cheques to my suppliers?

If you want to be secure from fraud or misuse of cheques then you should not provide a bearer check to your suppliers at any time. You should check always the word mentioned over the check ” or Bearer” and must strike out ” or Bearer”. You should provide an A/c Payee cheque or crossed cheque.

Who can withdraw the bearer cheques?

These are the persons who can get the amount mentioned over the bearer cheques-

- The person whose name is mentioned over the cheque means the recipient can deposit into his account by depositing the cheque.

- And the named recipient can also encash by visiting the branch after showing IDs if demanded.

- Any third person holding a bearer’s check can encash the cheque by visiting the branch after showing IDs if demanded.

- If there is no name mentioned on the bearer’s check, Then the individual presenting the cheque to the bank for encashment is only liable to get the entire payment.

Is the bearer cheque an open cheque?

A cheque is generally known as an Open check when it is not crossed whether it is made payable to the bearer or order.

How long is a bearer cheque valid?

Normally, a cheque will be valid up to three months from the date mentioned over the bearer check. Hence after three months from the date on the cheque, it will be invalid and can not be cleared or encashed.

How can I cash my bearer’s check?

If it is a bearer check

- You need to visit any branch (in the city) of the bank that the cheque belongs to

- then Present it for clearance

- The bank clearance system, will verify the details on the cheque and clear it

- The cheque will be cleared and the person whose name is mentioned over the cheque or any third person by authorization will get the cash.

Faqs on bearer cheque

There are seen many types of cheques which you need to understand. Here is the link for different types of cheques is provided plz go through and read- the types of cheques

A bearer cheque becomes an account payee cheque by writing “Account Payee” or crossing it twice with two parallel lines on the left-hand side top corner. The amount will be transferred to the account of the person specified on the cheque. It is considered the safest type of cheque and is also known as a crossed cheque.

Three parties are-

1. Drawer

2. Drawee

3. Payee.

Yes, It is a negotiable instrument.

it’s not mandatory to sign behind the cheque.

if a person self-representing any cheque he doesn’t need to sign behind the check, what if a third party is representing this cheque in a bank he has to sign behind the cheque for the record purpose.

A cheque will be a bearer cheque when the word ” or bearer” is mentioned over the cheque.

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.