How to reconcile GST Return-You would like to know the best tips on how to reconcile GST returns with books of account nowadays because I was also finding the best process to reconcile or match GST returns but I did not get any good way to reconcile.

It can be said that GST is new for all the Indian taxpayers from the date of implementation of GST in India on 01 July 2017. Hence nobody knows everything about GST cause of the new tax in the place of old taxes.

And GST COUNCIL is amending time to time rules and acts for making it easy for the taxpayers but after all, taxpayers are getting so many difficulties in work.

So now we are going to know the best tips on how to reconcile GST returns with books of account easily from time to time.

How to reconcile GST Return or match GSTR-1?

Firstly as per rules, every taxpayer needs to file GSTR-1 monthly or quarterly on the bases of turnover. The due date for monthly return is the 10th of the next month and for quarterly 31st of the next month.

So we need to start with GSTR-1- how to reconcile

Every taxpayer will file GSTR-1 before due date 10th of next month.

Before filing GSTR-1 check all details of GSTR-1 components related to outward supply

- Check GSTIN No detail right or not before making an invoice.

- Check your Invoice No series and date

- The tax rate is right or wrong

- Check the Credit note or Debit note detail

- Should check IGST or SGST and CGST applicability on the bases of intrastate or interstate supply

- Must check customer GST type- the composition or regular

- Should check GST tax amount ok with GST tax rate or not

- Lastly, check all outward supply data according to the requirement of GSTR-1 and 3b before filing, and then file your GSTR-1 before the due date.

After filing GSTR-1 check all detail of filed GSTR-1 with books of account

- As we have filed the GSTR-1 return on or before the due date so we need to check out whether we have filed return correctly or not.

- We can find some mistakes or errors that can be possible after filing GSTR-1.

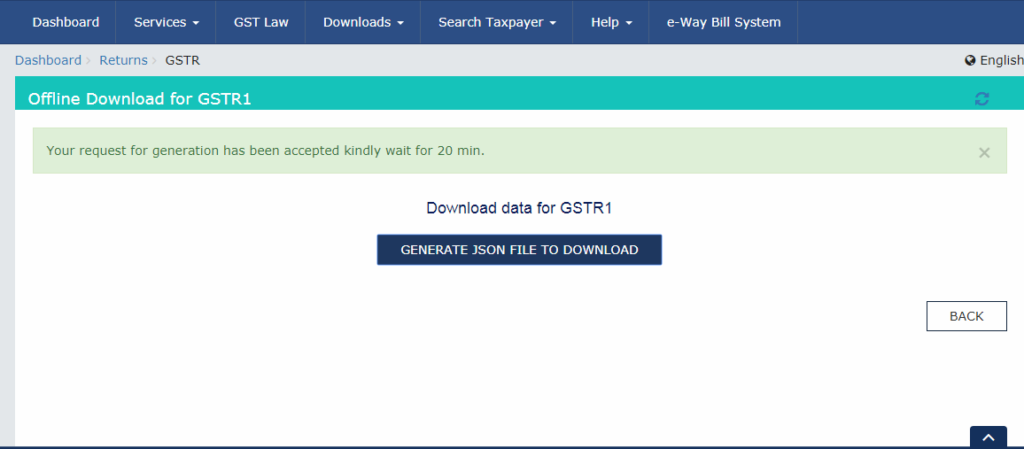

- For checking just download your filed GSTR-1 JSN file from the GST portal of the filed month

- And open with GST offline tool or can be viewed online on the portal

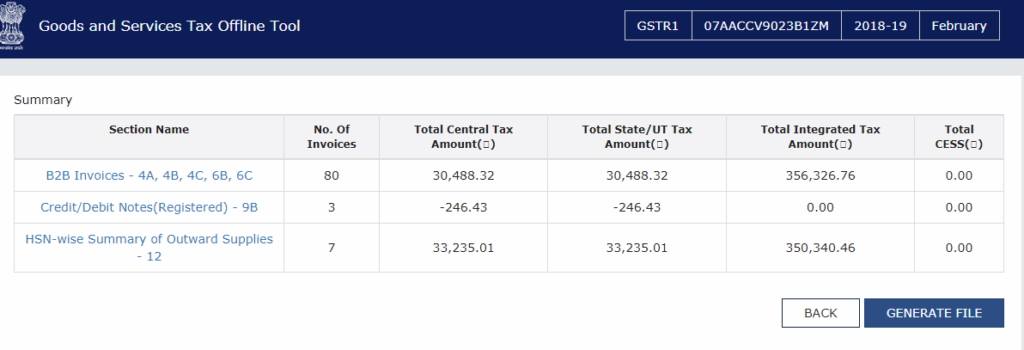

- Now open your offline tool and open your GSTR-1 file.

- Check your filed detail of supply is correct or not.

- Need to check invoice no and series match with your books of account.

- No. of invoices, credit note, debit note, the taxable amount of tax and.

- should check tax type mismatch also.

- check your total central tax, state tax, and integrated tax amount match or not.

- If not find the mistake cause that needs to be corrected in the next month’s GSTR-1.

- Finally, I would like to clarify that you should find the mistake or mismatch

- If any then that have to correct in the next month if not done that this mismatch goes far.

If you have checked all detail of GSTR-1 perfectly and all match then you are to file your GSTR-3B before the 20th of next month after GSTR-1

Here is very important to show outward supply detail in GSTR-3B after matching GSTR-1 and GSTR-1 should match with GSTR-3B

So fill the detail in GSTR-3B same as shown in the GSTR-1 report and if found a detail mismatch then finds out before filing GSTR-3B.

And more important you need to reconcile GSTR-2A also to file GSTR-3B cause where you are to show the input tax amount of inward supply for the accurate input tax credit.

- How to login Udyam Registration Portal?

- Delhi EWS/DG Admission for 24-25, Eligibility, Dates

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.

Wow, incredible blog layout! How lengthy have you been running a blog for?

you made running a blog glance easy. The whole

look of your website is fantastic, as well as the content material!

You can see similar: sklep and here sklep internetowy

Wow, marvelous blog layout! How lengthy have you been blogging for?

you made running a blog glance easy. The total glance of your web site is excellent, as well as the

content! You can see similar: ecommerce and

here sklep internetowy

Hello Folks,

For GST Reconciliation you can visit our website http://www.execkart.com, where you’ll find a number of ready formats for resume building and for the world of finance.

Execkart is a knowledge sharing platform where you will find a lot of details which will help youn excel in your carrer.

The link for GST Reco Format is https://www.execkart.com/product-page/gst-reconciliation-template

For tutorial on how to use this template you can watch the following video https://www.youtube.com/watch?v=DTQfPC4Tv20&t=291s