How to Unblock the GSTIN for the generation of e-waybill in the case of blocked GSTIN due to return not filed from last 2 months for generating an e-way bill which highly required to transportation of goods from one place to another.

As you know there are so many taxpayers who are not filing their GST returns on or before the due date.

They are filing them late and very late and because of this so, many recipient taxpayers are getting input tax credit issues.

That’s why the GST Council has given a notification to set this type of issue.

This means if you filed all last month’s GST returns then it’s ok otherwise you do not file your last two-month return (GSTR-1 AND GSTR 3B) then your GSTIN Number will not be able to issue an e-way bill online until you file GST Returns.

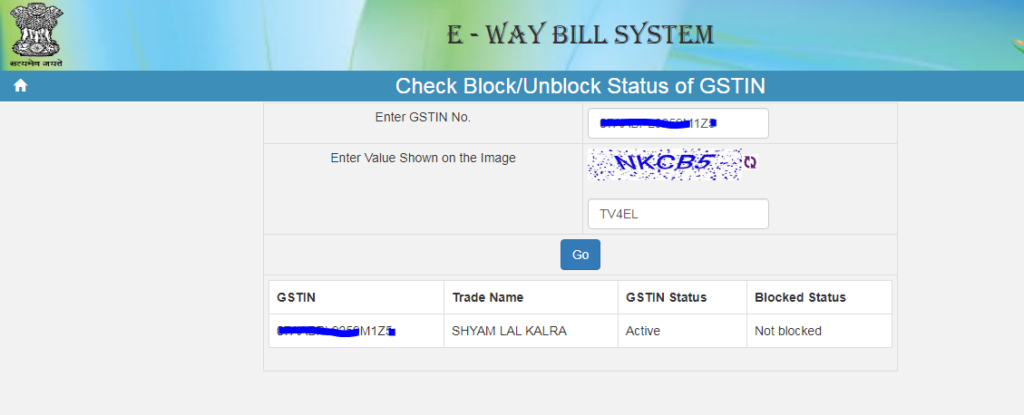

if your GSTIN is blocked due to this reason and wants to check and unblock then just go to the GST portal link GSTIN STATUS.

Contents of this post

When you can not issue the e-way bill?

You can not issue an e-way bill online if you did not file your last 2-month GST return hence your GSTIN will be blocked until you filed the pending returns.

How do get automatically unblock your GSTIN?

The user will be alerted while generating e-waybills in case the entered GSTIN has not filed the returns for the past 2 successive months as this GSTIN will be blocked for the generation of e-way bills.

On the filing of the Return-3B in the GST Common Portal, the block status will get automatically updated as ‘Unblock’ within a day in the e-waybill system.

How to unblock GSTIN manually?

On the filing of the Return-3B in the GST Common Portal, the block status will get automatically updated as ‘Unblock’ within a day in the e-waybill system.

However, if the status is not updated in the e-way bill system, then the taxpayer can go to the e-waybill portal and go to the option Search> Update Block Status. Then enter the GSTIN number and click on ‘Update GSTIN from Common Portal’.

This will fetch the status of Filing from GST Common Portal and if filed, the status in the e-way bill system will subsequently get updated

When you will get a notification of blocked GSTIN?

The user will be alerted while generating e-waybills in case the entered GSTIN has not filed the returns for the past 2 successive months as this GSTIN will be blocked for the generation of e-way bills.

How to save your GSTIN from blockage?

First of all, you will have to understand that you need to file your all GST returns on time or before time.

And if you did not file a return on time then should file your return within 2 months.

You should not avoid a due date.

- How to login Udyam Registration Portal?

- Delhi EWS/DG Admission for 24-25, Eligibility, Dates

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.