SBI balance checking -how it is so important to check your SBI bank balance within a minute or instant as an SBI Customer?

Yes, It is the activity for the many customers of SBI or any other bank. As usual, they want to check their bank balance anytime anywhere as a student, housewife, employee, or any businessman.

Contents of this post

- How many ways to check the SBI bank balance?

- SBI balance checking by Passbook

- SBI balance checking by bank visit

- SBI balance inquiry by ATM Card

- SBI balance check by SBI mobile banking app

- SBI balance inquiry by SBI Internet Banking

- SBI balance inquiry by SBI SMS Banking Service

- SBI balance inquiry by SBI Missed Call Banking Service

- SBI balance inquiry through the Toll-Free Customer Care No

- SBI balance check through the USSD Service

- SBI balance inquiry through the other Government recognized banking payment apps

How many ways to check the SBI bank balance?

At present, there are many ways to check SBI balance online or offline such as-

- Through the updated Passbook

- By visiting the bank branch to inquiry the balance

- Through the ATM CARD at any ATM anytime anywhere

- SBI Mobile banking app

- Internet banking online

- Through the SMS Banking Service

- By SBI Missed Call banking

- Through the Toll-free SBI customer care

- Through the USSD codes

- And through the other payment apps such as Phone Pe, Google Pay, and other Government recognized payment app

SBI balance checking by Passbook

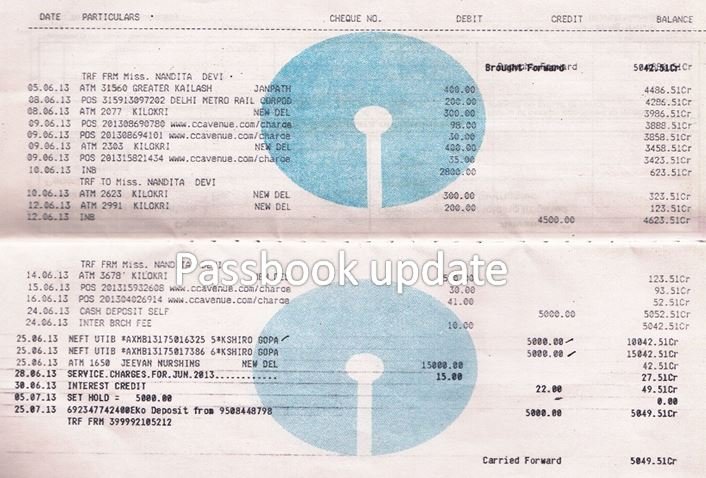

The first option to check or inquiry about your SBI bank balance is your PASSBOOK which is available for the customers to see updated bank balance and full bank statement means day to day entries of deposit and withdrawals.

For updating the passbook, the customer will have to go to the Bank in which his account or any nearest SBI branch.

After reaching the SBI branch, the customer can deposit and withdraw the amount and after that, he can update the passbook from the counter or from any passbook printer machine.

And the customer will see his last balance in his updated passbook.

SBI balance checking by bank visit

Now the second option is the bank visit for SBI balance checking when the customer is unable to get an updated passbook for any reason then the customer can know his balance at any counter by showing his passbook after requesting the bank officer.

SBI balance inquiry by ATM Card

The third option is available for SBI customers who have got an ATM CARD from their bank. And Through the ATM Card, the customer can do the same things as which he used to do by visiting banks.

Such as deposit cash, withdraw cash, check bank balance, online payment, or any counter payment and more.

So the customer can check his bank balance through ATM Card and for this customer will have to follow this process-

- First of all, insert ATM in ATM Machine slot

- Then enter your ATM password

- Now the menu will show just select option which you want to do

- For balance checking, just select option check balance or mini statement.

- and after selecting the option you will able to see the balance on screen or will get a mini statement of your bank account such as passbook.

SBI balance check by SBI mobile banking app

the fourth option is SBI launched app SBI YONO, in which the customer can register himself through the ATM OR account details and can generate his login user name or password for SBI balance checking.

After generating the user name or password, the customer will open the app by using a login id and password then he can see his bank statement or balance very easily anywhere and anytime just in his mobile.

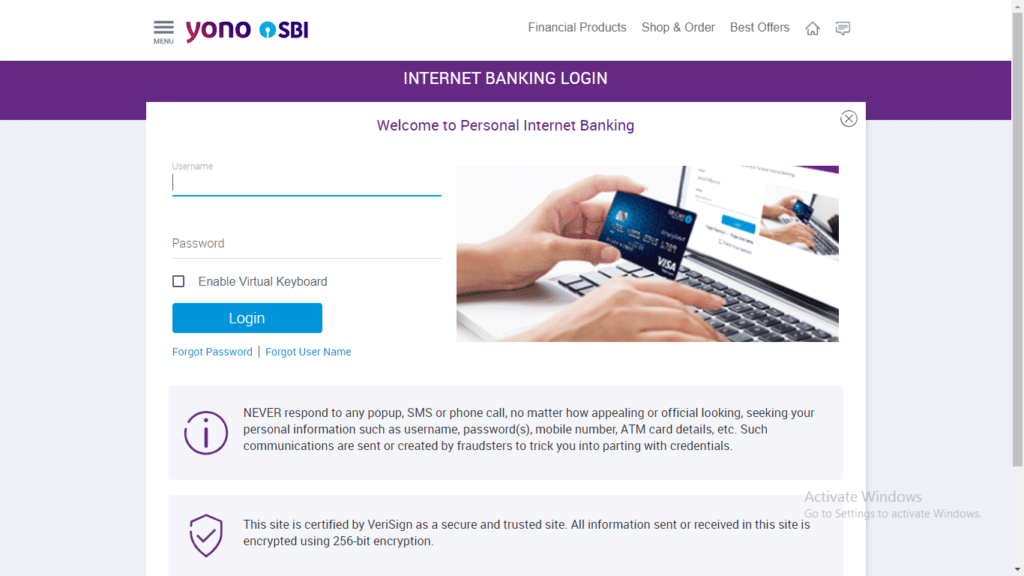

SBI balance inquiry by SBI Internet Banking

The fifth option is used often because of Digital India. Most of the customers are literate and able to use the internet so that the customer uses internet banking.

and the question is how to check SBI balance by internet banking for this the customer will have to use this process.

- First of all, the customer will request internet banking to the bank or can register online for internet banking with his account no and customer no.

- After registering for internet banking, the customer will get a user login ID and Password.

- Now the customer will open SBI internet banking through the site- https://retail.onlinesbi.com/retail/login.htm

- Then the customer can see his last balance or statement online just after login internet banking.

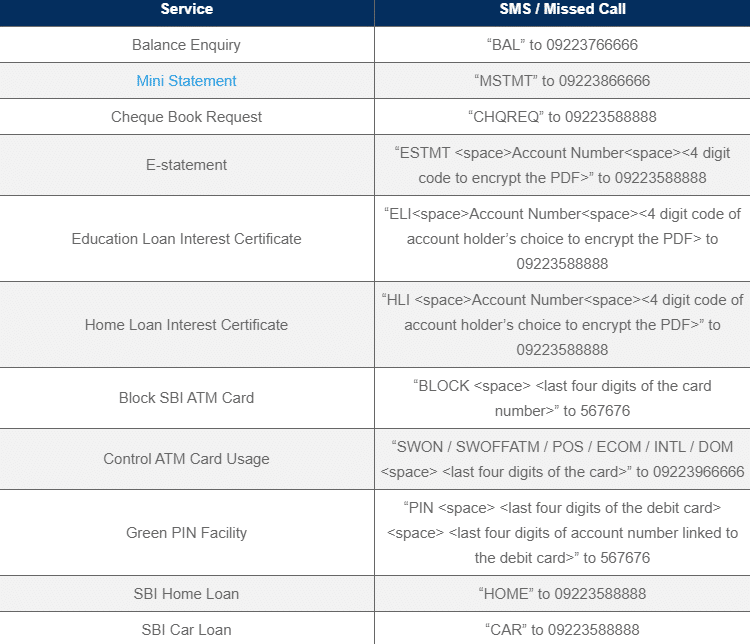

SBI balance inquiry by SBI SMS Banking Service

Now the sixth option to check SBI balance is the SBI SMS Banking service.

With the SBI SMS Banking service, account holders( customers) can check SBI account balances, manage a bank account, pay utility bills, and successfully transact anytime, anywhere.

In this SMS Banking Service, the customer can take benefits of all type of facilities such as

- Balance inquiry

- Cheque book request

- Mini statement

- E-statement

- Loan interest certificate

- Control and Block ATM Card

- SBI home loan and more.

For this, just the customer will have to SMS from his registered mobile no to the 09223588888, 09223766666, 09223866666 (Mobile no provided by the bank for SMS banking)

SBI balance inquiry by SBI Missed Call Banking Service

SBI Missed Call Service is a free service from the Bank wherein customers can get their Account Balance, Mini Statement, and more just by giving a Missed Call or sending an SMS with pre-defined keywords to pre-defined mobile numbers from your registered mobile number.

Missed call banking allows one to perform a number of banking operations just by giving a missed call or sending an SMS to the bank.

The service is also provided by SBI and includes SBI Balance Check, mini-statement, E-statement (last 6 months), and education loan certificate statement, home loan certificate statement, ATM configuration, generate ATM PIN, home and car loan details, social security schemes’ details, etc. This service is facilitated by RBI and provided by most banks in the country.

For using this missed call service, the customer will have to register first. This is a one-time process in which one has to send an SMS mentioning ‘REG<space>Account Number’ to 09223488888. A confirmation message from the bank will be sent mentioning that the service has been activated for the account.

After activation, the customer can do a missed call from his registered mobile no and can know his SBI bank balance.

SBI balance inquiry through the Toll-Free Customer Care No

The SBI customer can call the SBI Toll-free customer care no 1800112211 and 18004253800 for instant balance inquiry.

In this free service, customers can call to toll-free no and can follow the process on call and on-call the customer care officer can confirm his customer identity. After confirming identity customer will be able to know his account balance.

SBI balance check through the USSD Service

USSD (Unstructured Supplementary Service Data abbreviated) is a GSM communication technology used for the transmission of information between a mobile phone and an application program in the network. The SBI users holding Current/ Savings bank account are eligible to use this service features such as

- One can enquire about the account balance

- Get the mini statement (last 5 transactions)

- Money transfer to accounts

- Mobile Recharge

This is important to note that the customers already using Application based or WAP-based Mobile Banking Service will not be given access to use the service over USSD.

Hence in case, the existing user wishes to avail of the service, he/she needs to de-register from the App-based or WAP-based service before registering for the USSD service.

For activating the service, the customer will dial *595# by registered mobile no

The customer will get a response ‘’Welcome to State Bank Mobile Application”. Upon providing the correct User ID, then the customer will get the following response. Choose from the set of options given for the required service

- Inquiry

- Fund Transfer

- Mobile Top-up

- Change MPIN

- Forgot MPIN

- De-Register

SBI balance inquiry through the other Government recognized banking payment apps

The last option is other recognized banking payment apps such as

- Bhim app

- Google Pay

- UPI

- Phone Pe and other

When the SBI or other bank customers will register on these App through the registration process or steps of the apps.

Then the customer will get a 4 digit or 6 digit password to log in to the apps.

and the customer can access all banking facilities after login into these apps such as SBI APP.

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

- Stale cheque meaning, filling, example & benefits

- Self cheque filling, example, features & benefits

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.

Great article! I’m glad to know that SBI provides a simple and convenient way for customers to check their account balance. It’s so important to keep track of your finances, especially in today’s digital age. I’ll definitely be using this method to check my account balance from now on. Thanks for sharing!