Contents of this post

What is GSTR 7A?

GSTR 7A is a GST return form which represents a TDS certificate for both Deductor and Deductee under the GST Regime.

As a taxpayer no need to file Form GSTR-7A online.

Form GSTR-7A is a system generated TDS Certificate which is generated once the deductor furnishes a return in Form GSTR-7 on the GST Portal and the deductee accepts the details uploaded by the deductor and files his return.

This TDS Certificate will be available for both Deductor and Deductee.

What is the TDS Certificate under GST?

A TDS certificate is a certificate generated in Form GSTR-7A on the basis of information furnished in return by Deductor in his Form GSTR-7.

A single TDS certificate is issued per GSTIN for all the supplies, on which tax has been deducted for every GSTR-7 return filed. Form GSTR-7A is system generated TDS certificate and the signature of the Tax Deductor is not required.

How to view form GSTR-7A?

As TDS deductor and deductee, you will have to use these following steps to view GSTR7A:

- First of all, Access the GST Portal or www.gst.gov.in URL.

- The GST Home page will display.

- Login to the GST Portal with valid credentials.

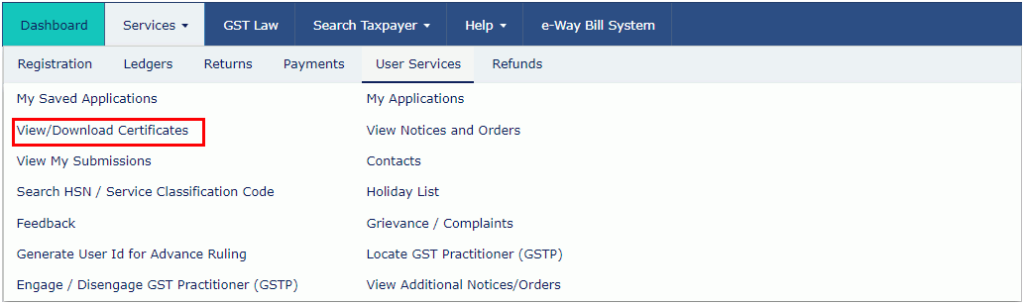

- Then click the Services > User Services > View/Download Certificates command

- The View/Download Certificates page will display. Click the TDS Certificate link.

- Select the Financial Year and Return Filing Period from the drop-down list.

- In the GSTIN of the Deductee field, you can also enter the GSTIN of Deductee.

- If the GSTIN of Deductee is not entered, the downloaded certificate will contain the details of deductees for the selected relevant period.

- Click the SEARCH button.

- The search results shall display. You can click the Download link to download the TDS Certificate.

- The TDS Certificate will display in PDF format

How can I download the TDS Certificate?

As TDS deductor and deductee, you will have to use these following steps to download TDS Certificate (GSTR7A):

- First of all, Access the GST Portal or www.gst.gov.in URL.

- The GST Home page will display.

- Login to the GST Portal with valid credentials.

- Then click the Services > User Services > View/Download Certificates command

- The View/Download Certificates page will display. Click the TDS Certificate link.

- Select the Financial Year and Return Filing Period from the drop-down list.

- In the GSTIN of the Deductee field, you can also enter the GSTIN of Deductee.

- Click the SEARCH button.

- The search results shall display. You can click the Download link to download the TDS Certificate.

- The TDS Certificate will display in PDF format

- How to login Udyam Registration Portal?

- Delhi EWS/DG Admission for 24-25, Eligibility, Dates

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.