Periodicity concept in Accounting-By this post, we shall study in detail the important periodicity concept out of 12 various accounting concepts on which accounting is based. If you have a business so you need accounting then you should know about these important periodicity concepts.

Contents of this post

What is the periodicity concept?

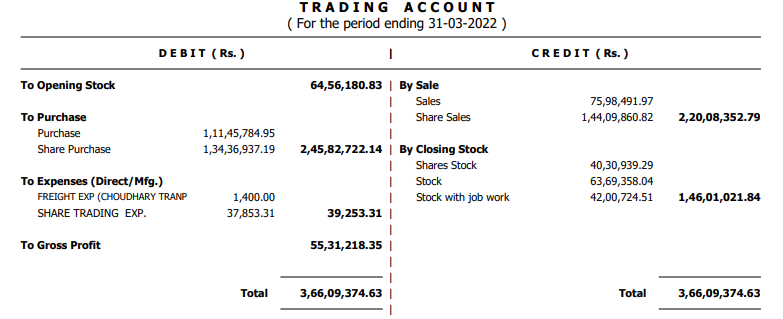

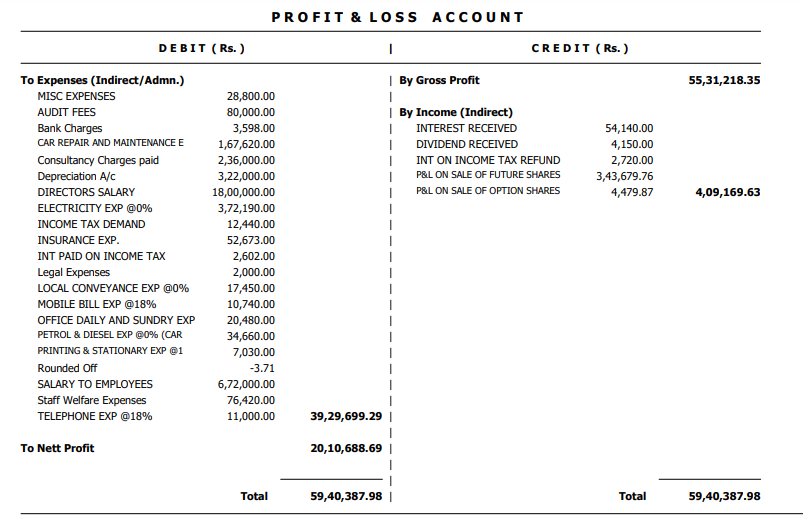

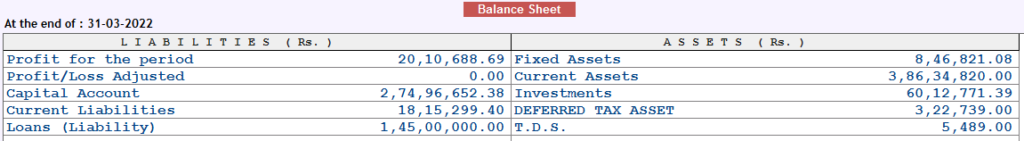

The periodicity concept states that an organization can report its financial statements within certain selected periods of time. It means that an entity consistently reports its results in financial statements on a monthly, quarterly, or annual basis. We generally follow from 1st April of a year to 31st March of the immediately following year. These time periods are kept the same over time, for the sake of comparability. For example, if the reporting period for the current year is set at calendar months, then the same periods should be used in the next year so that the results of the two years can be compared on a month-to-month basis.

Can you describe the periodicity concept with an example?

The periodicity concept is also called the concept of a specific accounting period. As per the going concern concept, an unspecified life of the entity is assumed. For a business entity, it causes inconvenience to measure performance achieved by the entity in the normal course of business.

If a cloth mill lasts for 90 years, it is not desirable to measure its performance as well as financial position only at the end of its life. So a small but workable fraction of time is chosen out of the infinite life cycle of the business entity for measuring performance and looking at the financial position. Generally, one year period is taken up for performance measurement and appraisal of financial position. However, it may also be 6 months or 9 months, or 15 months.

According to this concept, accounts should be prepared after every period & not at the end of the life of the entity. Usually, this period is one calendar year. We generally follow from 1st April of a year to 31st March of the immediately following year.

Thus, for performance appraisal, it is not necessary to look into the revenue and expenses of an unduly long time frame. This concept makes the accounting system workable and the term ‘accrual’ meaningful. If one thinks of an indefinite time frame, nothing will accrue. There cannot be unpaid expenses and non-receipt of revenue. Accrued expenses or accrued revenue is only with reference to a finite time frame which is called the accounting period.

What is the importance of the periodicity concept?

These are the importance of the periodicity concept in accounting to finalize accounts-

- Comparing of financial statements of different periods

- Uniform and consistent accounting treatment for ascertaining the profit and assets of the business

- Matching periodic revenues with expenses for getting correct results of the business operations

- Financial statement of a particular year or specified period.

How does the Periodicity concepts work?

This concept keeps an important role in the finalization of accounts of a specific period-

- it gives a financial position of certain period.

- financial statement made for a financial year which 01 april to 31 march.

- All the stakeholders- owners, suppliers, customers, management, and government can access all accounting information which is required regularly.

- This concept says break the life of a business into equal pieces and each piece (period) is known as accounting period.

- It can be

- 3 month

- 6 month

- 9 month

- 12 month

- but generally it is 1 year such as 01 april to 31 march, 01 jan to 31 dec, 01 july to 30 june.

- So we prepare financial statement at the end of the accounting period and we don’t change accounting period, same period is used contstaintly.

Further Faqs related to periodicity concepts

What is the definition of the periodicity concept?

The periodicity concept states that accounts should be prepared after every period & not at the end of the life of the entity. Usually, this period is one calendar year. We generally follow from 1st April of a year to 31st March of the immediately following year.

What happens when the periodicity concept is not observed?

This concept ensures that a specific period is required to see the financial position of a business. And if it is not specified in a period then it will be difficult to compare the financial statement of the different two periods. And will be unable to get correct results.

What is the significance of the periodicity concept?

The periodicity assumption states that an organization can report its financial results within certain designated periods of time. This typically means that an entity consistently reports its results and cash flows on a monthly, quarterly, or annual basis.

What is the description of the Periodicity Concept?

The periodicity concept states that the entity or the business needs to carry out the accounting for a definite period, usually the financial year. The period for drawing financial statements can vary from monthly to quarterly to annually. It helps in identifying any changes occurring over different periods.

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.