GST payment online

GST Online payment process for GST taxpayers is easy if you do not know or want to know the easiest way to pay online.

Firstly, you need to understand why and when you are liable to pay GST to the Government.

As per GST payment rules if you are supplying or providing any goods or services to your customer and charging or receiving tax like GST.

Then you are required to pay that charged GST to the government but after adjusting the GST tax paid on input supply or services like this example:

Contents of this post

- What are the simple steps for GST payment online?

- How many modes of online GST tax payment?

- How to create a challan for online GST payment?

- In the case of E-Payment

- How to create a challan for offline GST payment?

- In the case of Over the Counter

- In the case of NEFT/ RTGS

- List of authorized banks for GST payment online

- How to track GST Payment status?

- How to pay GST tax in the case of an unregistered Dealer?

- Can a third party make a GST payment online on behalf of a taxpayer?

- Benefits of Making GST Payments Online

- Faqs on GST payment online

What are the simple steps for GST payment online?

- First step- login to the GST portal

- The second step- go to the Services menu> Payments>Create challan or directly create challan from the option available in GSTR-3b return filing after the option proceed to payment

- In the next step fill in the tax payable detail as per gstr3b and choose the payment mode as e-payment, over-the-counter, and NEFT/RTGS.

- Then Generate challan and pay by any given payment mode.

- In the next step, you will see your payment amount in your Electronic cash ledger on the GST portal

- Finally, you can file your gstr3b after payment.

How many modes of online GST tax payment?

There are three ways or modes provided for GST tax payment which are given below:

online and offline payment mode

- E-payment-NET banking (internet banking), Credit/Debit Card

- over the counter

- NEFT/RTGS

How to create a challan for online GST payment?

First of all, you are logged into the GST portal by using a log-in user ID or password for creating a payment challan and if you want to create a challan before login then you should use this process.

To make the GST payment in pre-login mode, perform the following steps:

1. Access the https://www.gst.gov.in/ URL. The GST Home page will display.

2. Click the Services > Payments > Create Challan command.

3. The Create Challan page will display. In the GSTIN/UIN/TRPID/TMPID field, enter your GSTIN.

Note:

UN Bodies, Embassies, Government Offices, or Other Notified persons want to create a Challan in pre-login, they need to provide a Unique Identification Number (UIN).

In case Tax Return Preparers want to create a Challan in pre-login, they need to provide a Tax Return Preparer Identification Number (TRPID).

In the case an unregistered dealer having a temporary ID wants to create a Challan in pre-login, they need to provide a Temporary Identification Number (TMPID).

4. And in the Type, the characters as displayed below field, enter the captcha text.

5. Click the PROCEED button.

6. In the Tax Liability Details grid, enter the details of the payment to be made. The Total Challan Amount field and Total Challan Amount (In Words) fields are auto-populated with the total amount of payment to be made.

7. Select the Mode of E-Payment.

In the case of E-Payment

1. In the Payment Modes option, select the E-Payment as a payment mode.

2. Click the GENERATE CHALLAN button.

3. The OTP Authentication box appears. In the Enter OTP field, enter the OTP sent on the registered mobile number of the taxpayer whose GSTIN/UIN/TRPID/TMPID is entered.

4. Click the PROCEED button.

5. The Challan is generated. You can also download the GST Challan by clicking the DOWNLOAD button.

6. Select the Mode of E-Payment as Net Banking.

7. Select the Bank through which you want to make the payment.

8. Select the checkbox for Terms and Conditions apply.

9. Click the MAKE PAYMENT button

You will be directed to the Net Banking page of the selected Bank.

The payment amount is shown on the Bank’s website. If you want to change the amount, abort the transaction and create a new challan.

In case of successful payment, you will be re-directed to the GST Portal where the transaction status will be displayed. The payment receipt is displayed. To view the receipt, click the View Receipt link.

You can also make another payment by clicking the MAKE ANOTHER PAYMENT button.

How to create a challan for offline GST payment?

You can create a challan for offline payment after login and before login as follows:

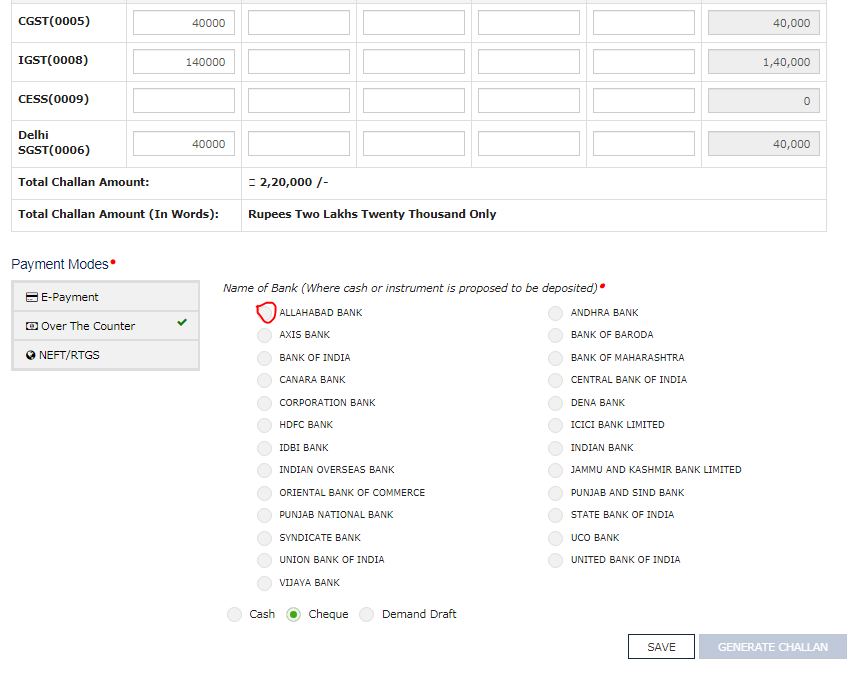

In the case of Over the Counter

1. In the Payment Modes option, select the Over the Counter as a payment mode.

2. Select the Name of the Bank where cash or instrument is proposed to be deposited.

3. Select the type of instrument as Cash/ Cheque/ Demand Draft.

4. Click the GENERATE CHALLAN button.

5. The OTP Authentication box appears. In the Enter OTP field, enter the OTP sent on the registered mobile number of the taxpayer whose GSTIN/UIN/TRPID/TMPID is entered.

6. Click the PROCEED button.

7. The Challan is generated. You can also download the GST Challan by clicking the DOWNLOAD button

8. Take a printout of the Challan and visit the selected Bank.

9. Pay using Cash/ Cheque/ Demand Draft within the Challan’s validity period.

10. The status of the payment will be updated on the GST Portal after confirmation from the Bank.

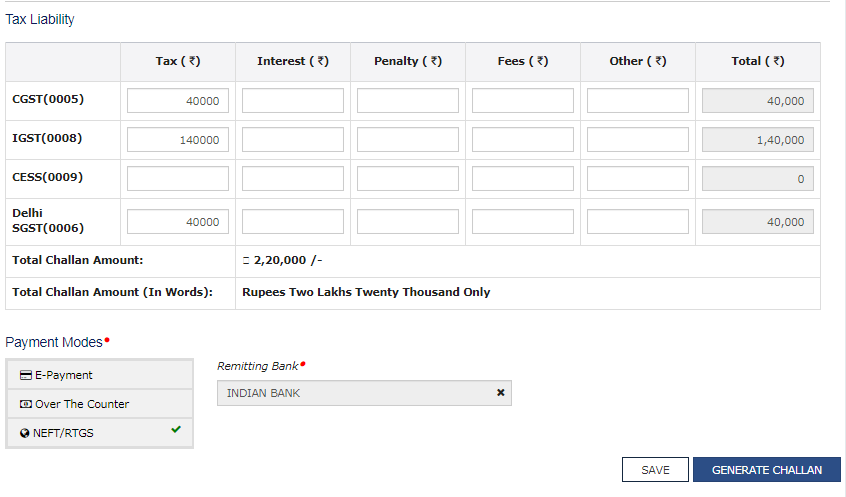

In the case of NEFT/ RTGS

1. In the Payment Modes option, select the NEFT/RTGS as a payment mode.

2. In the Remitting Bank drop-down list, select the name of the remitting bank.

3. Click the GENERATE CHALLAN button.

4. The OTP Authentication box appears. In the Enter OTP field, enter the OTP sent on the registered mobile number of the taxpayer whose GSTIN/UIN/TRPID/TMPID is entered.

5. Click the PROCEED button.

6. The Challan is generated. You can also download the GST Challan by clicking the DOWNLOAD button

7. Take a printout of the Challan and visit the selected Bank. The mandate form will be generated simultaneously.

8. Pay using a Cheque through your account with the selected Bank/ Branch. You can also pay using the account debit facility.

9. The transaction will be processed by the Bank and RBI shall confirm the same within <2 hours>.

10. Once you receive the Unique Transaction Number (UTR) on your registered e-mail or mobile number, you can link the UTR with the NEFT/RTGS CPIN on the GST Portal. Go to Challan History and click the CPIN link. Enter the UTR and link it with the NEFT/RTGS payment.

11. The status of the payment will be updated on the GST Portal after confirmation from the Bank.

12. The payment will be updated in the Electronic Cash Ledger in respective minor/major heads.

List of authorized banks for GST payment online

- ALLAHABAD BANK

- ANDHRA BANK

- BANK OF BARODA

- DENA BANK

- BANK OF INDIA

- CENTRAL BANK OF INDIA

- CANARA BANK

- CORPORATION BANK

- HDFC BANK

- IDBI BANK

- ICICI BANK LTD

- INDIAN BANK

- INDIAN OVERSEAS BANK

- BANK OF MAHARASHTRA

- ORIENTAL BANK OF COMMERCE

- J & K Bank

- PUNJAB AND SIND BANK

- PUNJAB NATIONAL BANK

- STATE BANK OF INDIA

- SYNDICATE BANK

- UNION BANK OF INDIA

- UCO BANK

- UNITED BANK OF INDIA

- AXIS BANK

- VIJAYA BANK

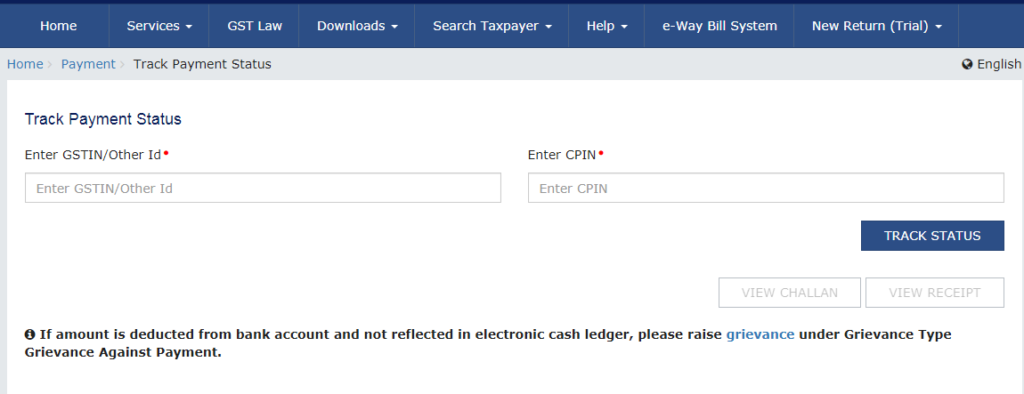

How to track GST Payment status?

You can log in to the GST portal and track payment status but if you want to track the status of a GST payment without logging into the GST Portal, perform the following steps:

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed

2. Click the Services> Payments > Track Payment Status command.

3. In the Enter GSTIN field, enter your GSTIN.

4. In the Enter CPIN field, enter your CPIN.

5. In the Type, the characters as displayed below field, enter the captcha text.

6. Click the TRACK STATUS button.

The payment status is displayed. To view the challan, click the VIEW CHALLAN button.

If the status of Challan is FAILED / NOT PAID and the mode selected is E-Payment, the Taxpayer can click on the VIEW CHALLAN button, select the Bank, Terms, and Conditions, and click on the MAKE PAYMENT button to make the Payment again for the Failed or Not Paid challan.

If the Payment status is PAID, then the VIEW RECEIPT button is enabled and the Taxpayer can view the receipt and also download the receipt after clicking on the VIEW RECEIPT button. In case of any other Status of challan (other than PAID), the Taxpayer will be able to View the Challan.

How to pay GST tax in the case of an unregistered Dealer?

Unregistered persons can generate a Challan against the temporary ID allotted to them. he can create challan by using TID.

Can a third party make a GST payment online on behalf of a taxpayer?

Yes, a third party can make payments on behalf of a taxpayer. The third party can make payments by mentioning the correct GSTIN against which the payment needs to be made.

Benefits of Making GST Payments Online

These are the benefits of making GST payments online-

- Convenience: Paying GST online can be done from the comfort of your home or office, saving you the hassle of visiting a physical tax office.

- Accuracy: Online systems are designed to minimize errors, ensuring that your tax payments are accurate.

- 24/7 Accessibility: You can make GST payments online at any time, even during non-business hours.

- Instant Confirmation: Online payments provide immediate confirmation and receipt, reducing uncertainty.

- Transparency: Online platforms offer complete transparency in your tax transactions.

Faqs on GST payment online

No, it’s not mandatory, but it is highly recommended for its convenience and efficiency.

Some payment methods may have associated charges, so check with your bank or payment service provider.

Yes, you can make consolidated payments for multiple tax periods in a single transaction.

If you face any issues, contact the GST helpdesk or your bank for assistance.

GST payments should be made within the prescribed due dates to avoid penalties and interest.

- How to login Udyam Registration Portal?

- Delhi EWS/DG Admission for 24-25, Eligibility, Dates

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.

certainly like your website but you need to take a look at the spelling on quite a few of your posts Many of them are rife with spelling problems and I find it very troublesome to inform the reality nevertheless I will definitely come back again

Great post! I’m glad to see that you’ve updated your guide on how to pay GST online in India. As a business owner, it’s crucial to stay informed about the latest developments in GST payment procedures, and your post has been a valuable resource for me. Thank you for sharing your expertise!

Hi Ben,thanks for the good work – really helped me a lot setting up a google Dashboard for social media monitoring!For the facebook problem I could find a workaround extracting the likedata out of the meta-data of the fb page. It’s clunky (I think it gets tangled up in the fb security check), but it works in the long run. Using the following formula:=IMPORTXML(https://www.facebook.com/buzzfeed, “//meta[@name=’description’]/@content”)returns the string:“BuzzFeed. 8.189.336 likes · 1.507.877 talking about this. Worth sharing.”REGEXEXTRACT gets the value of likes/followers out of the string, here for values up to hundreds of millions:=Value(Regexextract(G59,”([0-9]\d0,3.[0-9]\d0,3.[0-9]\d0,3|[0-9]\d0,3.[0-9]\d0,3|[0-9]\d0,3).likes”))(which for sure can be optimized).Best,Jo