2FA Mandatory for E-waybill & E-invoice login

As we know that we are using a user id and password for login E-waybill & E-invoice which is not highly secure in this digital world. Hence for enhancing security a 2-factor authentication will be mandatory for E-waybill & E-invoice login.

In the last update dated June 12, 2023, the e-Way Bill and e-Invoice System introduced a significant security enhancement called 2-Factor Authentication (2FA). This measure is aimed at ensuring the safety and integrity of the system. And starting from July 15, 2023, all taxpayers with an Annual Aggregate Turnover (AATO) above Rs 100 crore will be required to mandatorily use 2FA when accessing the e-Way Bill and e-Invoice System.

Contents of this post

- What is 2FA for E-waybill and E-invoice?

- How many ways to use 2FA in e-waybill and e-invoice?

- When can I register for 2FA in login E-waybill and e-invoice?

- How do I register for 2-Factor Authentication on the EWAY bill?

- What is the purpose of 2FA in E-waybill and E-invoices?

- How to disable 2FA in e-waybill and e-invoice?

- Faqs on 2FA mandatory for E-waybill and e-invoice

What is 2FA for E-waybill and E-invoice?

2-Factor Authentication (2FA) is the best feature for an extra layer of security to the login process of the e-Way Bill and e-Invoice System. In addition to the regular username and password, users will now need to authenticate themselves using a One-Time Password (OTP) to access the system. And this will help to prevent misuse of your e-way bill and e-invoicing dashboard.

How many ways to use 2FA in e-waybill and e-invoice?

There are three different methods for 2FA in e-waybill and e-invoice system login. For generating the OTP, users may choose any of these options to receive the authentication code:

1. 2FA SMS on Registered Mobile Number

First is SMS OTP, When logging in, an OTP will be sent to the taxpayer’s registered mobile number via SMS. This method ensures that the authentication code is conveniently delivered to the user’s mobile device. And no other person can log in without Otp.

2. 2FA Otp on Sandes App

Sandes App is a messaging app provided by the government so that you can send and receive messages. You may download and install the Sandes App on your registered mobile number and receive the OTP in it. Click here to view the guidelines and procedure to install it.

3. 2FA Otp on NIC-GST-Shield App

The NIC-GST-Shield app is a mobile application specifically designed for the e-Way Bill and e-Invoice System. This app is provided by e-Way Bill /e-Invoice System to generate OTP and use it for authentication. This app once installed and registered on your registered mobile number, you will not require internet or any dependency on the mobile network. On opening the app, OTP is displayed. You may enter this OTP and continue the authentication.

When can I register for 2FA in login E-waybill and e-invoice?

You may register or de-register this facility at any time using the link ‘2 Factor Authentication–>Registration’. This facility is being introduced on an optional basis, presently, all taxpayers with an Annual Aggregate Turnover (AATO) above Rs 100 crore will be required 2FA mandatory for E-waybill when accessing the e-Way Bill and e-Invoice System. however, in the future, it will be made mandatory for all.

Note:

The OTP authentication is based on individual user accounts. That is, the sub-users of GSTIN will have separate authentication depending on their registered mobile number in the e-Way Bill and e-Invoice System.

Once you have Registered for 2 Factor authentication then the same is applicable for both the e-Way bill and the e-Invoice system.

How do I register for 2-Factor Authentication on the EWAY bill?

These are the simple steps to register 2FA on the e-way bill and e-invoice login-

1st option-registered mobile number

- First of all, login with your user id and password as usual, you were logging.

- Now after login, just click on the 2-factor authentication option in the menu.

- Then click on Registration for 1st 2FA option-Registered Mobile Number.

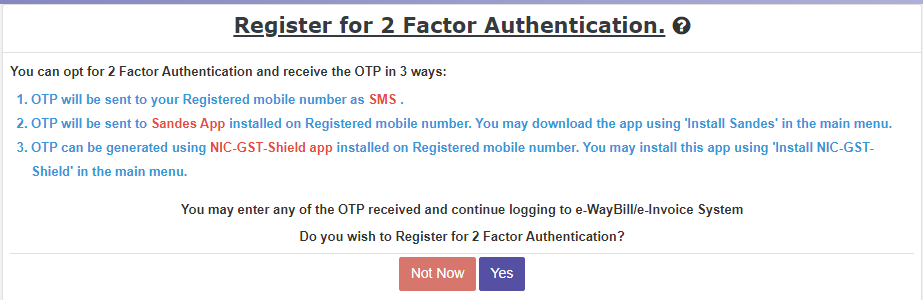

- Now a pop will show as

- Now click on Yes you want to register for 2FA. An OTP will be sent to your registered mobile number then enter.

2nd option is Sandes App

- First of all, login with your user id and password as usual, you were logging.

- Now after login, just click on the 2-factor authentication option in the menu.

- Then click on Registration for 2nd 2FA option-Sandes App

- a pop will show

- you need to follow the pop- just download Sandes App.

- Then you will have to register with your registered mobile number or email id then you will be shown an Otp in Sandes App. For more details and faqs just visit –https://www.sandes.gov.in/resources/um/faq.pdf

3rd option is Sandes App

- First of all, login with your user id and password as usual, you were logging.

- Now after login, just click on the 2-factor authentication option in the menu.

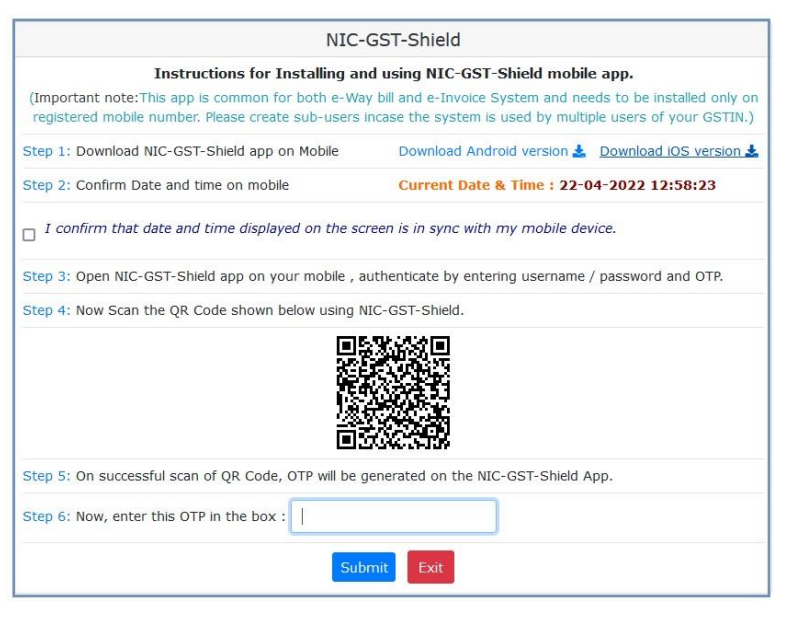

- Then click on Registration for 3rd 2FA option-NIC-GST-Shield App

- For using this app you need to download and sync it with your mobile as follows

- One must ensure that the time displayed in the NIC-GST-Shield app is in sync with the e-Invoice/ e-waybill system.

- On opening this app, a one-time password is displayed.

- The assessee could enter this OTP and continue with the authentication process. Every 30 seconds, the OTP gets refreshed. The assessee doesn’t require the internet to generate the OTP on this app.

- For more information plz check https://docs.ewaybillgst.gov.in/Documents/NIC-GST-Shield.pdf

What is the purpose of 2FA in E-waybill and E-invoices?

The GST department has introduced a two-factor authentication process for best securities which helps in

- Accessing the e-invoice system and e-way bill system more efficiently, and

- Enabling the e-invoice system to be more efficient and robust, and

- Ensuring a secure environment for accessing the e-invoice and e-way bill system.

- And for stopping misuses by a third person 2FA is Mandatory for E-waybill in case of turnover above 100 cr.

How to disable 2FA in e-waybill and e-invoice?

If you have registered for 2 Factor authentication, then the same is applicable for both the e-Way bill and the e-Invoice system. You may de-register this facility anytime using the link ‘2 Factor Authentication → Registration / Deregistration’.

Faqs on 2FA mandatory for E-waybill and e-invoice

Yes, as per notification, all taxpayers having a Turnover above 100cr will have to use 2-factor authentication to enhance security.

Yes, all taxpayers can register for 2FA to enhance security but it is not mandatory for those who have turnover below 100cr.

Yes, you can disable it anytime if you do not need it.

It is required to enhance security features and enable e-waybill more efficient.

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.