list of GST payment forms that are available for the payment of GST tax payable under the GST act. Firstly, we need to know when you are required to pay GST tax and then which form will be used to pay.

In other words, there are many forms available for GST tax payment online or offline. Therefore in this post, we are going to study the list of all GST payment forms.

Check out the list of forms for GST REGISTRATION

- List of GST appeal forms- types of forms for appeal

- GST demand and recovery forms-List of GST forms

- List of GST ITC forms- Types of form GST ITC

- List of GST assessment forms- Types of assessment

- List of GST refund forms- Types of refund forms

- List of GST payment forms- types of GST payment

- GST Return Forms-List & Uses (Updated)

- GST Registration forms-list & Uses (updated)

What are the types of GST tax payment forms?

Types of GST tax payment forms-

FORM GST PMT-01

This is the form of payment available for the taxpayer.

This is an Electronic liability register for the taxable person

Form GST PMT -01 has two-part

1 Return-related liability

- 2 other return-related liability

The electronic liability register is available to maintain in the FORM GST PMT-01 for each person who is liable to pay tax, interest, late fee, penalty, or any other amount on the common portal.

And all liable amounts payable by him shall be debited to the said register.

FORM GST PMT-02

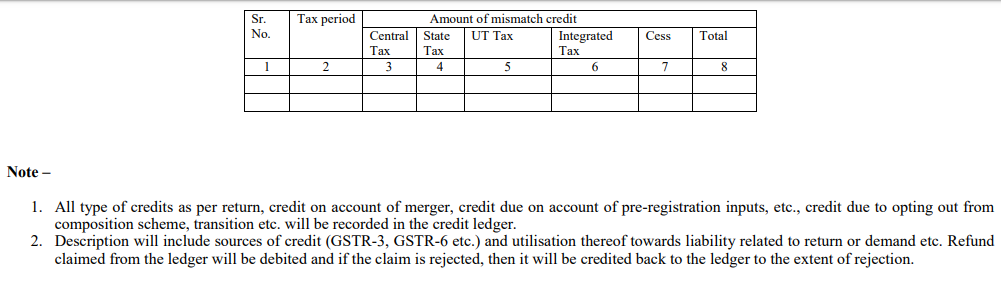

This form is an Electronic credit ledger for the taxable registered person.

It is available on the common GST portal to maintain the credit of input tax to utilize for tax payment.

As a taxpayer, you can see your available credit of input taxes as per the return in your FORM GST PMT-02 (electronic credit ledger).

It has the source of credit return GSTR 3B OR GSTR-6.

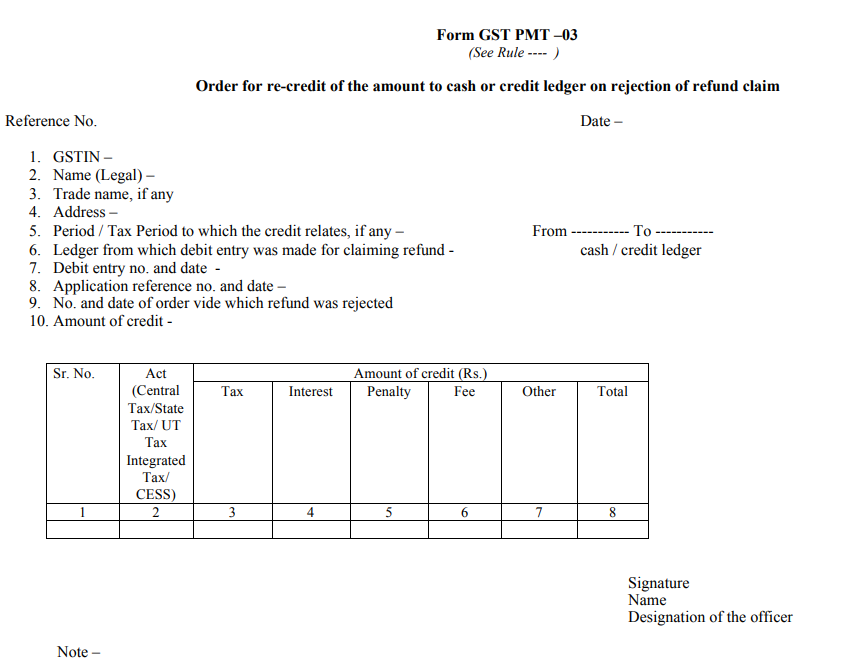

FORM GST PMT-03

This form is available for tax officials.

It is a form of an order for re-credit of the amount to cash or credit ledger on rejection of refund claim.

FORM GST PMT-04

Application for intimation of discrepancy in Electronic Credit Ledger/Cash Ledger/Liability Register.

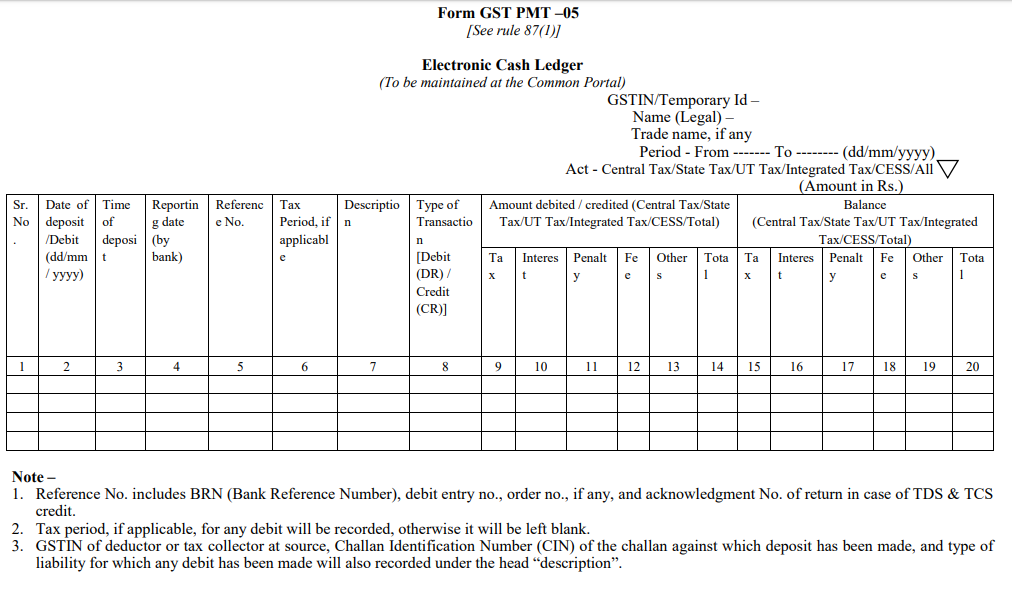

FORM GST PMT-05

It is the form for the taxpayer on the common portal.

This form is an electronic cash ledger on the GST common portal.

All the GST tax payments will reflect in the electronic cash ledger through the mode of net banking, debit card, and the tax challan payable on the bank.

The payment made through the FORM GST PMT-06 (PAYMENT CHALLAN) will show in the electronic cash ledger.

FORM GST PMT-06

This is challan for the deposit of goods and services tax available for the taxpayer.

It is the challan that is necessary to create at the time of filing the GSTR-3b where you will have to pay balance tax after utilizing the input tax credit available on purchase.

Then you will have to use this challan for payment for filing the return.

This challan has many payments mode as NEFT/RTGS/IMPS, DEBIT CARD, CASH, CHEQUE, DEMAND DRAFT, and OVER THE COUNTER.

FORM GST PMT-07

This is a form available for the taxpayer.

This is an application for intimating discrepancy relating to the payment.

GST PMT-07 is to report the discrepancy between the over and less deducted amount of tax.

FORM GST PMT-08

- Form for declaring self-assessed tax liability to claim ITC

FORM GST PMT-09

- Form to reallocate balance available in electronic cash ledger to major/minor heads

- List of GST appeal forms- types of forms for appeal

- GST demand and recovery forms-List of GST forms

- List of GST ITC forms- Types of form GST ITC

- List of GST assessment forms- Types of assessment

- List of GST refund forms- Types of refund forms

- List of GST payment forms- types of GST payment

- GST Return Forms-List & Uses (Updated)

- GST Registration forms-list & Uses (updated)

Is it compatible with the Seagte Exos X18 18TB drive? REPLY ON YOUTUBE