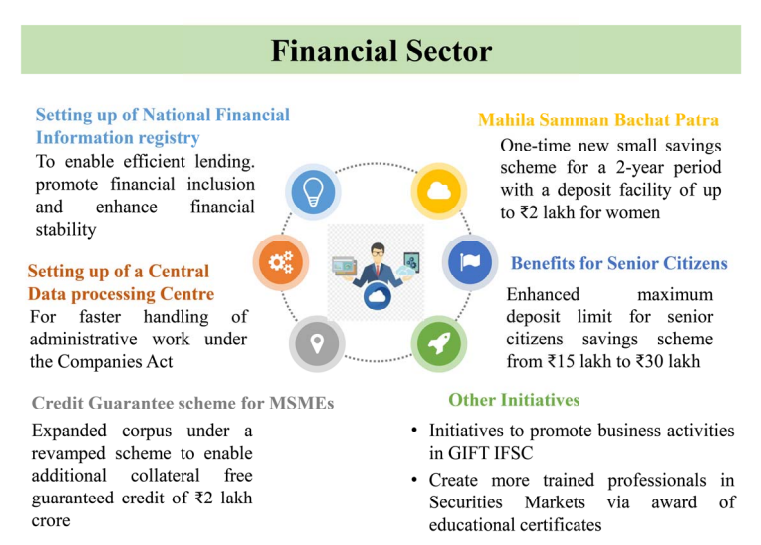

Mahila Samman bachat Patra is a one-time new small saving scheme for a period of 2 years with a deposit facility of up to 2 lacks for women. This scheme is introduced in the union budget 2023-24 by the finance minister- Nirmala Sitharaman ji on 1 Feb 2023.

Contents of this post

- What is Mahila Samman saving scheme?

- What do you mean by Mahila Samman?

- What is the Mahila Samman saving certificate?

- Who is eligible for a deposit into Mahila Samman Saving Scheme?

- Where can I find out about the Mahila Samman Bachat Patra?

- What is the interest rate in Mahila Samman Patra?

- Faqs on Mahila Samman Bachat Patra

What is Mahila Samman saving scheme?

Mahila Samman saving scheme is a one-time base new small saving scheme for women in India. According to this scheme, a woman can deposit up to 2 lacks for a fixed interest @ 7.5%. It will be the best scheme to save and earn higher interest.

What do you mean by Mahila Samman?

Mahila Samman is the name of a one-time new small saving scheme which is introduced by the Smt. Nirmala Sitharaman in current union budget 2023-24.

What is the Mahila Samman saving certificate?

It is a saving certificate that will be issued to the women who will deposit money in the newly introduced scheme- Mahila Samman saving scheme. It will work as a supporting document for the deposit.

Who is eligible for a deposit into Mahila Samman Saving Scheme?

A woman or a girl can deposit into the newly introduced scheme called Mahila Samman bachat Patra or Mahila Samman Saving Scheme.

Where can I find out about the Mahila Samman Bachat Patra?

You can see the latest union budget for more details about Mahila Samman Saving Scheme. You can view Union Budget 2023-24.

What is the interest rate in Mahila Samman Patra?

In this scheme, a fixed rate of interest will be given @ 7.5%

Faqs on Mahila Samman Bachat Patra

It is introduced in the Union budget 2023-24 by the Smt. Nirmala Sitharaman.

No, It is only for females means women.

A woman can deposit up to 2 lacks.

It will be available for 2 years up to 31 march 2025.

Yes, You can use the partial withdrawal option also.

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.