SBI bank statement is the most significant part of your banking account. It can be understood that every person above 18+ is having one bank account. And someone has more than one bank account in different types of banks in India. Today, we will know about the different ways to view and download SBI bank statements online and offline.

Contents of this post

- What is the SBI bank statement?

- Why is an SBI bank statement required?

- How can I view the SBI bank statement?

- How to view the SBI bank account by passbook?

- How to view the SBI account statement by missed call?

- Can I get the SBI account statement by SMS?

- Can I get the SBI account statement by email?

- How can I get the SBI account statement by mobile banking?

- How can I get an SBI bank statement through net banking?

- How can I get an SBI mini statement through ATM?

- How can I get SBI bank statements through Yono SBI App?

- How can I download my SBI bank statement online?

- How to download SBI bank statements through net banking?

- How to download SBI bank statements through mobile banking?

- Faqs on SBI bank statements

What is the SBI bank statement?

SBI bank statement is a statement having details of all day-to-day banking transactions of a period related to a particular SBI account holder. SBI bank provides a bank passbook to every account holder for getting details of all transactions done by the account holder. This bank passbook will be printed by the bank official and then the printed transactions are called the SBI bank statements. It can be in form of an online pdf, passbook, message, etc.

Why is an SBI bank statement required?

It is required in this all situations such as

- To view all related transactions

- To maintain a record of all transactions

- For identification of non-related transactions.

- For verification of Account Details.

- To confirm income for ITR filing

- Required in case of bank loan and credit card apply

- It can be used for address verification

- Required for making day-to-day entries in accounts of a business.

How can I view the SBI bank statement?

You can view your SBI bank statement with the help of different modes of SBI bank utilities-

- bank passbook

- SBI Missed call

- SMS service

- Mail service

- SBI mobile banking

- SBI net banking

- And SBI ATM

You can view the SBI statement through anyone which is easy for you.

How to view the SBI bank account by passbook?

You can see your SBI bank statement through your bank passbook offline. You will have to visit your SBI bank branch to get your passbook printed. After printing the passbook, you can see all banking entries in your passbook related to you such as cash withdrawal, cash deposit, payment to someone, and receipt from someone else.

How to view the SBI account statement by missed call?

Through the SBI Missed Call Service, You can check your mini statement instantly. You need to give a missed call on 09223866666 from the registered mobile number and after that, you will receive an SMS with your mini statement. This is one of the easiest ways to check the mini statement as it is accessible even without the internet.

If you are not registered for Missed call service then send an SMS “REG Account Number” to 9223488888. This feature enables you to Register Your Mobile and account number for Missed Call Banking. An SMS is triggered to 9223488888 for Registration.

Steps to get SBI mini statement by missed call

1. Firstly, Give a missed call for SBI Mini Statement to number 09223866666 to know about the last 5 transactions.

2. Then the call will disconnect after two rings.

3. The user will get an SMS with the SBI Mini Statement i.e. recent 5 transactions initiated from the account.

Can I get the SBI account statement by SMS?

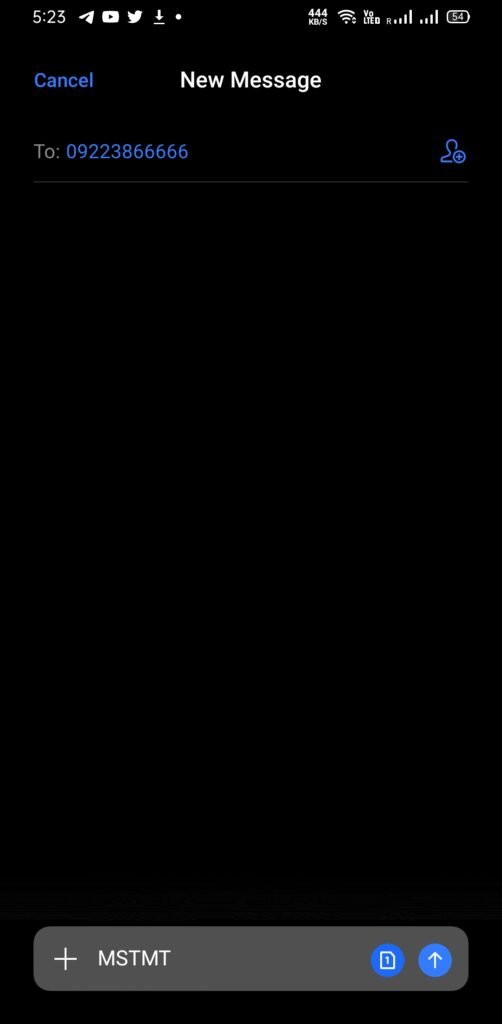

Yes, An account holder can get SBI mini account statement with the help of SMS. To get the SBI Mini Statement by SMS, the account holder should send an SMS – ‘MSTMT’ and send it to 09223866666. The SBI Mini Statement with details of the last five transactions will be sent to the registered mobile number.

Can I get the SBI account statement by email?

Yes, Customer can get their SBI account statement through email in pdf format by using this Feature. They simply need to send an SMS to 09223588888 from the registered mobile number as ESTMT<space><Account Number><space><Code>*

*Code is a 4-digit number that will be used to open the password-protected attachment.

How can I get the SBI account statement by mobile banking?

Following are the steps to get SBI Mini Statement using mobile banking services:

1: Firstly, Download the‘ SBI Anywhere Personal’ – SBI Mobile Banking app from the google play store or apple app store

2: Then Log in to SBI Anywhere app using the login credentials

3: Then on the SBI Mobile Banking app home page, select the “My Accounts” option

4: On the next menu, select the ‘Mini Statement’ option

5: Check SBI Mini Statement which includes 10 recent transactions in the account

How can I get an SBI bank statement through net banking?

Following are the steps to get SBI bank Statement using SBI net banking services:

1. Firstly, visit the official site of the State bank of India-https://retail.onlinesbi.com/

2. On-site, click on “continue to login” then log in with your user Id and Password

3. After login, you will be displayed on your dashboard, on the dashboard you can see your last 10 transactions by clicking on “Click here for last 10 transactions“.

4. And if you want to see a statement for more than 10 days then click on the “account statement” option on the dashboard.

5. After clicking, just select your account and click on the view option to see the bank statement as per the selected period.

6. You will be displayed your bank statement on the screen. You can check out easily.

How can I get an SBI mini statement through ATM?

following are the steps to get SBI mini Statement using SBI ATM services:

1. Firstly, Visit the nearest SBI ATM.

2. Insert your ATM card into the machine and enter ATM Pin.

3. You will see an option of Mini statement, just touch & click on Mini statement

4. Then select an account type. Now your transaction will be processed.

4. Then you will be able to see your SBI mini statement instantly through the atm receipt.

How can I get SBI bank statements through Yono SBI App?

Following are the steps to get SBI bank Statement using SBI Yono app:

1. Firstly, Open the SBI Yono app on your mobile and log in with your MPIN ID.

2. After login, you will see your SBI Yono dashboard

3. Here click on Accounts then select your saving accounts.

4. Then the details of your transactions will be displayed, you can see your statement or can download it instantly on your mobile that can be viewed by a password then use your account number to open a pdf.

How can I download my SBI bank statement online?

You can download your SBI bank statement online easily with the help of SBI services such as

- SBI net banking

- Sbi mobile banking

How to download SBI bank statements through net banking?

Following are the steps to get SBI bank Statement using SBI net banking services:

1. Firstly, visit the official site of the State bank of India-https://retail.onlinesbi.com/

2. On-site, click on “continue to login” then log in with your user Id and Password

3. After login, you will be displayed on your dashboard, on the dashboard you can see your last 10 transactions by clicking on “Click here for last 10 transactions“.

4. And if you want to see a statement for more than 10 days then click on the “account statement” option on the dashboard.

5. After clicking, just select your account and click on the view option to see the bank statement as per the selected period or click on the download format in which you want to download the statement quickly. You will have to select formats such as pdf, excel, and text to download your SBI bank statement.

6. Here you will have to click on the pdf option then your pdf file for the selected period of time will be downloaded.

7. Now you can get a printout of that and also can share it with someone who needs it.

How to download SBI bank statements through mobile banking?

Following are the steps to get SBI bank Statement using mobile banking with the SBI Yono app:

1. Firstly, Open the SBI Yono app on your mobile and log in with your MPIN ID.

2. After login, you will see your SBI Yono dashboard

3. Here click on Accounts then select your saving accounts.

4. Then the details of your transactions will be displayed, you can see your statement or can download it instantly on your mobile that can be viewed by a password then use your account number to open a pdf.

Faqs on SBI bank statements

How can I get my Sbi bank statement?

You can get your SBI bank statement instantly. There are many options are available through which you can view and download your SBI bank statement. To know just visit above all ways are mentioned there.

Can I get my SBI bank statement on mobile?

Yes, you can get your SBI bank statement on mobile through Sbi mobile banking apps such as SBI YONO APP.

Can I get my SBI bank statement without internet banking?

Yes, you can use many ways to get an SBI bank statement without net banking such as

1. SMS, 2. ATM, 3. EMAIL, 4. Missed call, 5. Passbook.How can I get SBI bank statement offline?

You can visit your SBI bank branch and can demand a bank statement printout for a certain period of time or can get a passbook printed.

What is the password for opening to SBI bank statement via email?

The consumer has to enter the last five digits of the registered mobile number and date of birth in the DDMMYY format. For example, if a mobile number is XXXXX13458 and DOB is 25 August 1990 then the password will be 13458250890.

SBI bank statement pdf password

You can open your bank statement that is downloaded in a PDF format, just enter the password, which is your 11-digit account number without putting the prefix 0.

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.