DIN-How to search CBIC DIN (Document Identification Number) with the help of the DIN utility available on the CBIC website after releasing the notification on 5 NOV 2019.

According to the notification, CBIC has decided to generate and quote of Document Identification Number on any communication issued by the officers of the CBIC (Central Board of Indirect Taxes and Customs to the taxpayers and another concerned person.

Contents of this post

What is DIN?

DIN (Document Identification Number) is a digitally generated number of a document that is issued to the taxpayers or concerned person as notifications or communications by CBIC officers.

And CBIC can use Document Identification Number for all communications which includes

- Search authorization

- summons

- Inspection notices and letter

- Arrest memo

These all types of notices and letters issued in the course of any inquiry shall be issued by any officer under the CBIC. And the digital platform for the generation of DIN is hosted on the DDM’s (Directorate of Data Management) online portal which is cbicddm.gov.in

What are the benefits of CBIC DIN?

The CBIC is implementing a system for the electronic generation of a document identification number for all communications sent by its officers to taxpayers and other concerned people.

There are some benefits for example

- It would create a digital directory for maintaining a proper audit trail of such communication.

- It would provide the recipient’s such communication with a digital facility to ascertain their genuineness.

- A proper digital record of any communication.

- It will help to know the fake communication in the name of CBIC.

- A digital platform will help search and identify any issued Document Identification Number.

Can communication be issued without Document Identification Number?

Yes, The communication can issue without any DIN by the CBIC officers in some crying situations such as

- When any technical issue or difficulty in generating the electronic Document Identification Number.

- And when the communication is regarding an investigation or inquiry is required to issue on short notice or in some urgent situations

- When the authorized officer is outside the office in the discharge of his duties.

And after all, if any communication is issued without Document Identification Number or above exceptions then the document will be assumed invalid.

And the communication issued in a crying situation will be justified.

the proper officer will regularize it after getting the approval of that communication document from the immediate superior officer after justifying that the document is issued and valid.

Then the proper officer will issue that communication document by generating a Document Identification Number within 15 days of its issuance.

What is the format of DIN?

This is a valid format of a digitally generated DIN( Document Identification Number) –CBIC-YYYYMMZCDRNNNNNN

for example-

And this format has 20 characters which includes

- YYYY denotes the calendar year.

- MM denotes the month of the calendar year.

- ZCDR denotes the Zone Commissionerate Division Range Code of the field formation of the authorized user generating the Document Identification Number.

- NNNNNN denotes the alphanumerical random numbers.

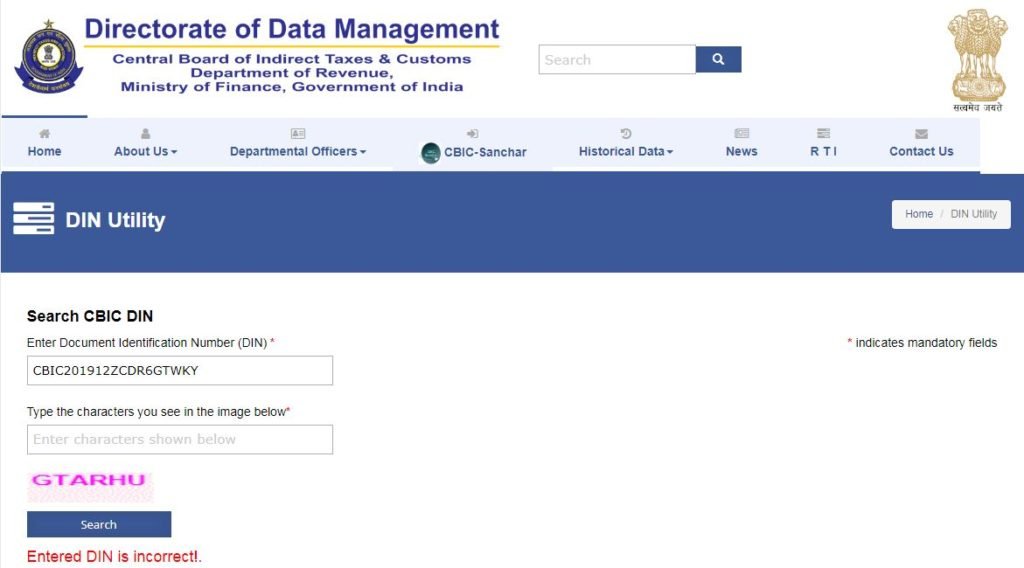

How to confirm whether the issued CBIC DIN is genuine or fake?

After implementing Document Identification Number for CBIN communication it will be easy to know whether the document is genuine or fake with these simple steps-

- First of all, search in Google CBIC or site link www.cbic.gov.in OR directly search site link-cbiddm.gov.in

- Then open the CBIC website and click on the highlighted link to verify CBIC DIN after this you will reach the on-site of DDM-Directorate of Data Management or Document Identification Number utility

- Now enter the 20-digit Document Identification Number received from the CBIC Board regarding any issue.

- After that just click on the search button

- Now you can confirm the document is valid if found and if not found then that is invalid.

- Then the Document Identification Number utility will show a msg of Entered DIN is incorrect

How to Issue Document Identification Number?

It may be noted that at present the Document Identification Number is only required for the documents issued by the department. The taxpayer has to file the reply/comply manually. Hence only the department can generate DIN through the Directorate of Data Management (DDM)’s online portal “cbicddm.gov.in”.

How to verify DIN?

steps to verify DIN-Document Identification Number

1. Firstly, visit to the cbic Website-https://www.cbic.gov.in/

2. Then click on any Menu then click on link-VERIFY CBIC-DIN

3. After click, you will see DIN search Window.

4. Now Enter DIN Number in the field required and type the capcha.

5. Then click on submit Button. if You found searched your DIN with same Details Then it is valid.

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.