Aadhar Authentication- Now as per the notification on GST Portal, An existing taxpayer can authenticate his identity online on GST Portal. It is available for all taxpayers who have not completed their Aadhar Authentication or KYC or for re-KYC.

And the functionality for Aadhaar Authentication and e-KYC where Aadhaar is not available has been deployed on GST Common Portal with effecting from 6th January 2021, for existing taxpayers. All taxpayers registered as Regular Taxpayers (including Casual Taxable persons, SEZ Units/Developers), ISD, and Composition taxpayers can do their Aadhaar Authentication or e-KYC on GST Portal.

Excluding- Government Departments, Public Sector Undertakings, Local Authorities and Statutory Bodies because this is not applicable for these.

Contents of this post

What is Aadhaar Authentication or e-KYC?

This is only for Authentication of identity of Proprietor/Partner/Director /Managing Partner/ Karta of the entity registered on GST Portal. and here two situations may be- when

Aadhaar is available– In this case, the Primary Authorized signatory and 1 person who is Proprietor/Partner/Director /Managing Partner/ Karta of the entity registered can go for the Aadhaar Authentication.

In absence of Aadhaar-In this case, they can upload any of the following documents to undergo e-KYC such as

- Aadhaar Enrolment Number

- Passport

- EPIC (Voter ID Card)

- KYC Form

- Certificate issued by Competent Authority

- Others

What are the steps for Aadhar Authentication on GST Portal?

You can Authentication your identity on GST Portal by using these easy steps for Aadhar Authentication-

1. First of all, Access the www.gst.gov.in URL. The GST Home page will display. Login to the GST Portal with valid credentials i.e. your user id and password.

2. After login, A pop-up message window will display with the question “Aadhaar Authentication facility is available. Would you like to authenticate Aadhaar of Partner/ Promoter and Primary Authorized Signatory? “. Two options will display: YES, NAVIGATE TO MY PROFILE, and REMIND ME LATER.

3. Then, the taxpayer needs to select the option, YES, NAVIGATE TO MY PROFILE, the My Profile page will display. The following two options display on the My profile page:

- Send Aadhar Authentication link

- Upload E-KYC Documents

Send Aadhar Authentication link

1. In case the taxpayer selects the option, SEND AADHAAR AUTHENTICATION LINK, the color of the tab changes from blue to green, and the Aadhaar Authentication Status page display.

2. Now select the Promoter/ Partner for Aadhaar authentication by selecting the check box in the Select for Aadhaar Authentication column. Selecting the check box changes the status as Aadhaar Authentication required.

3. In case, the column of Promoter/ Partner displays more than one name, the taxpayer can select only one name out of them.

4. If the Promoter/ Partner is the same as the Primary Authorized Signatory, in that case, the check box against the name would be auto-selected and the taxpayer is required to directly click the SEND VERIFICATION LINK.

5. Click the SEND VERIFICATION LINK to send link to the selected promoter/ partner.

6. A pop-up message window is displayed stating the link has been shared on the registered Email and mobile number.

7. Click OK to close the window. and the status gets changed to Pending for Aadhaar Authentication.

8. Once you have clicked on SEND AADHAAR AUTHENTICATION LINK, an authentication link will be shared on GST registered mobile number and e-mail IDs of the Promoters/ Partners and Authorized Signatories.

9. And this Aadhaar authentication link will be received on e-mail IDs of the Promoters/ Partners or Authorized Signatories as mentioned in the registration application and is valid only for 15 days.

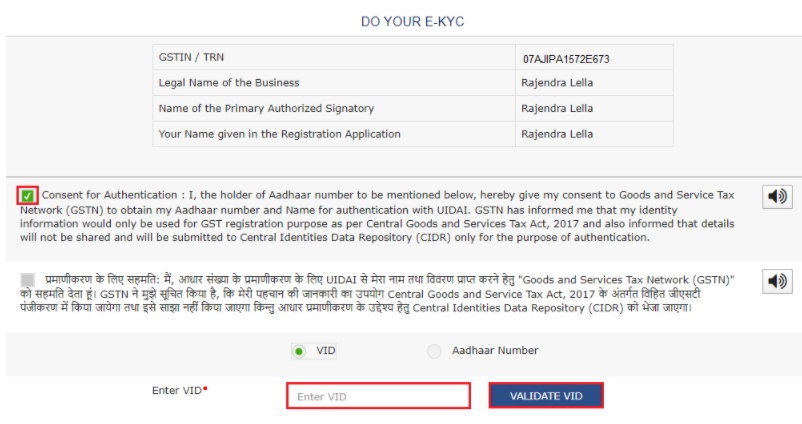

10. Click the authentication link received on GST registered mobile number and e-mails IDs of the Promoters/ Partners, Authorized Signatories. Select the Consent for Authentication. Enter your VID or Aadhaar Number.

11. Enter the OTP sent to the email and mobile number of the Authorized Signatory registered at the UIDAI and click the VALIDATE OTP button.

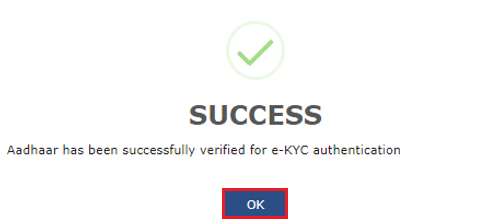

12. A success message is displayed when Aadhaar is successfully verified for e-KYC authentication. Click OK.

Upload E-KYC Documents

- First of all, To upload E-KYC documents, click the UPLOAD E-KYC DOCUMENTS tab.

- Now clicking the tab turns the color of the tab from blue to green and the details of promoter/ partner and Primary Authorized Signatory will display.

- Then click the Type of E-KYC Document drop-down list to select the type of document for E-KYC. The list of types of documents that can be attached is displayed.

- Then, select the document from the list that you wish to upload.

- After that, click the UPLOAD DOCUMENTS button.

- Then A confirmation message is displayed that documents have been uploaded successfully.

Is Aadhar Authentication mandatory on GST Portal?

No, it is not mandatory for every authorized signatory, promoter, or partner to get Aadhaar authenticated for a new GST Registration. Aadhaar authentication is based on the constitution of business (COB).

The following table explains and lists the Aadhaar authentication for different constitution of business for Regular Tax Payer (Including Casual, SEZ, ISD) and Composition Taxpayer.

| Proprietorship Concern | Proprietor Authorized Signatory | Yes (1 Proprietor + Primary Authorized Signatory) |

| Partnership Firm | Partner Authorized Signatory | Yes (1 Partner + Primary Authorized Signatory) |

| HUF | Karta Authorized Signatory | Yes (1 Karta + Primary Authorized Signatory) |

| Company (Public, Private, Unlimited) | Director Authorized Signatory | Yes (1 Director + Primary Authorized Signatory) |

| Company (Foreign Limited) | Director Authorized Person in India | Yes (Authorized Person in Charge in India + Primary Authorized Signatory) |

| Limited Liability Partnership | Designation Partner Authorized Signatory | Yes (1 Partner + Primary Authorized Signatory) |

| Society/Club/Trust/Association of Person | Members of Managing committee Authorized Signatory | Yes (1 Member of Managing Committee +Primary Authorized Signatory) |

| other | Person In charge Authorized Signatory | Yes (1 Person In charge +Primary Authorized Signatory) |

Other FAQS related to Aadhar Authentication on GST Portal

You should read other FAQS if have some doubts-

1. If selected No, would the Taxpayer need to upload E-KYC documents for all the persons listed in the Aadhaar Authentication tab?

No, if the Taxpayer selects No for Aadhar Authentication, then the E-KYC documents could be uploaded only for PAS and one promoter/ partner which the Taxpayer can select from the list available.

2. While using the authentication link for Aadhaar authentication, where will I receive the OTP?

You will receive common OTP on mobile number and E-mail ID linked with your Aadhaar on UIDAI Portal for its authentication.

3. What would happen next after a taxpayer has uploaded the EKYC documents?

Once taxpayer has uploaded the documents then an ARN will be generated and it will go to the Tax Official queue who can either approve or reject the documents.

4. The KYC documents are pending for authentication with the Tax official, can the taxpayer upload different documents meanwhile?

No, till the time Tax official doesn’t take any action on the ARN/ EKYC documents uploaded by the taxpayer for authentication, the taxpayer won’t be able to upload documents again. However, if the Aadhaar Authentication is pending then the taxpayer can send a link for Aadhaar Authentication during this time.

5. For how many days will the Aadhaar authentication link received on the Email IDs of the Promoters/ Partners or Authorized Signatories be valid?

The Aadhaar authentication link received on Email IDs of the Promoters/ Partners or Authorized Signatories be valid only for 15 days.

6. As the Aadhaar authentication link will be sent on registered Email ID and Mobile Number, the OTP received on both will be the same or different?

The OTP received on registered mobile number and Email ID will be a common/ same.

7. I closed the pop-up message that appears as a reminder for Aadhaar Authentication when I log in to the GST portal. How do I access the link now?

You can go to My Profile page from Dashboard and click the Aadhaar Authentication Status tab under Quick Links section.

8. How would I get to know that the link has been sent to Promoter/ Partner and Primary Authorized Signatory for Aadhaar Authentication?

Once you click the SEND VERIFICATION LINK tab, the status gets changed to Pending for Aadhaar Authentication.

All information is taken from the GST Portal if you want to confirm further then just visit GST Portal News

- MAHAGST login- How to login mahagst.gov.in

- How to get a GSTIN number?

- Documents Required for GST Registration

- Misuse of PAN: 6 Steps to register a complaint

- How to do Aadhar Authentication/ e-KYC on Portal

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.