TDS on Sale of Property in India sec 194IA– A new TDS Section 194-IA of the Income Tax Act was proposed in the finance bill 2013, According to this section from 01 June 2013, when a buyer buys immovable property costing more than Rs 50 lakhs, then the buyer has to deduct tax at source (TDS) when he pays the seller.

In this post, we will try to know all faqs about TDS on the sale and purchase of property in India. And before, we need to know basic things such as

Contents of this post

- What is TDS on Property?

- Who is liable to pay TDS on the property?

- How can I file TDS for the sale of the property?

- How is TDS calculated on the Sale of Property?

- What should I do as a buyer of Property?

- What should I do as a seller of Property?

- What information is required to enter in the form 26QB?

- What are the requirements for TDS on the sale of Property?

- What is the TDS rate on the Sale of Property?

- What happens if TDS on the sale of a property is not deducted?

- What are the penalties on non-filing of Form 26QB?

- How to claim TDS on sale of Property?

- Can the seller pay TDS on the property on behalf of the buyer?

- More FAQs

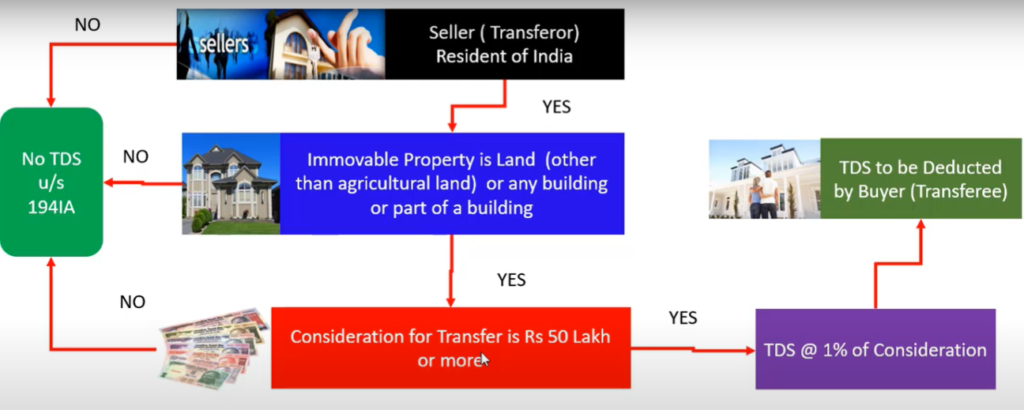

What is TDS on Property?

- TDS on Property sec 194IA

- According to this section from 01 June 2013, when a buyer buys immovable property

- such as a building or part of a building or any land other than agricultural land

- having cost more than Rs 50 lakhs,

- Then the buyer has to deduct tax at source (TDS) when the buyer pays the purchase amount to the seller.

Who is liable to pay TDS on the property?

According to the rules in respect of TDS sec 194IA, The buyer of the property would have to deduct the TDS and the same have to deposit in the Government treasury. Note, the seller is not liable to deduct TDS under section 194IA.

How can I file TDS for the sale of the property?

A buyer need to deduct or deposit the TDS on property cost more than 50 lac. Here, buyer can use this simple steps to deposit or file TDS online-

- First of all, the buyer needs to fill the challan form 26QB online to pay TDS.

- To pay TDS, the buyer will visit nsdl.com to fill the challan form 26Qb

- Under ‘TDS on sale of the property’, click on “Online form for furnishing TDS on property (Form 26QB)”

- then select the applicable challan as “TDS on Sale of Property”.

- Fill the complete form as applicable.

- For filling the form you will be required details such as

- PAN of the seller & buyer

- Communication details of seller & buyer

- Property details

- Amount paid/credited & tax deposit details.

- Now submit the duly filled form to proceed. Then a confirmation screen appears.

- After confirming, a screen appears showing two buttons as “Print Form 26QB” and “Submit to the bank“. A unique acknowledgment number is also displayed on the screen.

- It is advisable to save this acknowledgment number for future use.

- And then click on “Print Form 26QB” to print the form.

- Then click on “Submit to the bank” to make the required payment online through internet banking. Then proceed to the payment page through the internet banking facility of various banks.

- On successful payment, a challan counterfoil will display containing CIN, payment details, and bank name through which e-payment has been made. This counterfoil is proof of payment being made.

How is TDS calculated on the Sale of Property?

TDS required to deduct @ 1% and .75% for period of 14.05.21 to 31.03.21. And TDS is to be paid on the entire sale amount.

For example, if you have bought a house at Rs 60 lakh, you have to pay TDS on Rs 60 lakh and not on Rs 10 lakh (i.e. Rs 60 lakh – Rs 50 lakh). This is applicable even when there is more than 1 buyer or seller.

Post the budget 2019 amendment to section 194-IA, in the above example, if on 1 September 2019, you have paid Rs 2 lakh towards parking fee, Rs 1 lakh for the water facility fee, and Rs 1 lakh for electricity fee, your sale consideration would be Rs 64 lakh (60+2+1+1). You will have to pay TDS on Rs 64 lakh @ 1%. Your TDS payable would be Rs 64,000. In case the transaction is carried out from 14 May 2020 to 31 March 2021, the rate is 0.75% Hence, TDS payable would be 48,000.

And in case of payment consideration in installments where the value of property 60 lakh more than 50 lakh limit then TDS also application at the time of Part payment or installment. Such as there are 3 installments decided of 20 lakh each then TDS will be deducted and deposited in each installment payment.

What should I do as a buyer of Property?

- First, Deduct tax @ 1% or 0.75% from the sale consideration which will depend upon the Date of Payment/Credit to the Seller.

- Second, Collect the Permanent Account Number (PAN) of the Seller and should verify the same with the Original PAN card.

- Third, the PAN of the seller, as well as the Purchaser, should be mandatorily furnished in the online Form for furnishing information regarding the sale transaction.

- Fourth, Do not commit any error in quoting the PAN or other details in the online form as there is no online mechanism for rectification of errors. Because for the purpose of rectification you are required to contact Income Tax Department.

What should I do as a seller of Property?

- First, Provide your PAN to the Purchaser for furnishing information regarding TDS to the Income Tax Department.

- Second, Verify the deposit of taxes deducted by the Purchaser in your Form 26AS Annual Tax Statement.

- Third, Get form 16b from the buyer.

What information is required to enter in the form 26QB?

These all information is required to enter in the form 26QB which is given below-

1) Permanent Account Number (PAN) of Property Purchaser and Seller.

2) Then, Address of the Purchaser, Seller as well as the property being purchased

3) Then, Financial Year during which the Purchase has been made

4) After that, Major Head Code – To indicate the type of tax applicable that is Tax on companies/Tax on other than companies

5) Then Value of Property

6) Date of agreement/booking

7) Amount Paid/credited (Transaction amount)

8) Rate of TDS

9) TDS Amount

10) Dates of payment/credit, deduction

11) Select the option for Payment of taxes on Subsequent Date

What are the requirements for TDS on the sale of Property?

The requirements for TDS on the sale of Property are-

- No TDS is required to be deducted if sale consideration is less than Rs 50 lakhs.

- If the payment is made by installments, then TDS has to be deducted on each installment paid.

- The buyer has to deduct TDS @ 1% of the total sale consideration. Note that the buyer is required to deduct TDS, not the seller. The rate is 0.75% for transactions carried out from 14 May 2020 to 31 March 2021.

- The buyer of any immovable property need not obtain a TAN (Tax Deduction Account Number) for making payment of the TDS on immovable property. You can make the payment using your PAN.

- For the purpose of making payment of TDS on immovable property, the buyer has to obtain the PAN of the seller, else TDS is deducted at 20%. PAN of the buyer is also mandatory. TDS is deducted at the time of payment (including installment payments) or at the time of giving credit to the seller, whichever is earlier.

- The TDS on the immovable property has to be paid using Form 26QB within 30 days from the end of the month in which TDS was deducted.

- After depositing TDS to the government, the buyer is required to furnish the TDS certificate in form 16B to the seller. This is available around 10-15 days after depositing the TDS.

- The buyer is required to obtain Form 16B and issues the form to the seller. You can check the procedure to generate and download Form16B from TRACES here.

What is the TDS rate on the Sale of Property?

- The buyer has to deduct TDS @ 1% of the total sale consideration. Note that the buyer is required to deduct TDS, not the seller.

- The rate is 0.75% for transactions carried out from 14 May 2020 to 31 March 2021.

What happens if TDS on the sale of a property is not deducted?

The income tax department started to match the TDS data with the data they received from the property registrar for property transactions over 50 lakh. Wherever there was a discrepancy, either the buyers failed to deduct or deposit the TDS, a notice has been sent to the buyer of the property.

And if you have not deposited the deducted TDS on property within time to the income tax department. Then, you may have to give a penalty of up to 1 lac.

What are the penalties on non-filing of Form 26QB?

There may be a buyer have to give penalties as interest, late fees if TDS is not deducted such as

Interest @1% per month for the period from the date on which TDS is deductible/collectable to the date on which TDS/TCS is actually deducted.

Interest @1.5% per month for the period from the date on which TDS is deducted to the actual date of payment.

Late fees, In case of default of non-filing or late filing of Form 26QB, a penal fee is applicable under section 234E of the income tax act. Rs. 200 has to be paid for every day during which such failure continues. The buyer would also be liable for defaults of late Deduction, late payment, and interest thereon.

Penalty– An Assessing Officer may levy a penalty under section 271H at his discretion. This section is applicable when a statement as required by the tax laws is not submitted timely. The penalty under this section must be more than Rs 10,000 and can extend to Rs 1lakh. However, if TDS is deposited with a fee & interest and statement is submitted within 1 year of the time prescribed, no penalty shall be levied.

How to claim TDS on sale of Property?

There is a simple process to claim TDS on sale of property just need to follow this steps-

- First of all, At the time of sale of the property, the buyer is required to deduct TDS on the property and deposit the same with the government on time.

- Ensure, the seller should provide a pan card to the buyer for deducting TDS.

- And then the seller should verify that the property buyer has deposited the taxes deducted from sale consideration and should be reflecting in the seller’s Form 26AS Annual Tax Statement.

- After verifying, the seller should get form 16b (TDS Certificate) from the buyer for further confirmation or as proof.

- Now, the seller is able to claim TDS deducted on the sale of property by the buyer.

- Then the seller can claim TDS at the time of filing his Income Tax return.

Can the seller pay TDS on the property on behalf of the buyer?

According to sec 194IA, The responsibility to deduct TDS on Property Sale rests solely with the Buyer. Even, if it is financed by Home Loan or property is purchased from the builder. But In some cases, Bank can deduct TDS on the property from disbursement and help in depositing TDS on buyers’ behalf but they are not obliged to do so. Therefore, You have to give a written request to Bank for the same.

More FAQs

There are many more FAQS which you would like to know and we have collected all from the source of NSDL

1. What if I don’t have the PAN of the seller, is it Mandatory?

PAN of the seller is mandatory. The same may be acquired from the Seller before effecting the transaction.

2. What is Form 26QB?

The online form available on the TIN website for furnishing information regarding TDS on property is termed as Form 26QB

3. I have filled Form 26QB and made the payment online, but I forgot to save the Acknowledgment Number generated on the TIN website. From where can I get the Acknowledgment Number?

a) Acknowledgment number for the Form 26QB furnished is available in the Form 26AS (Annual Tax Statement) of the Deductor (i.e. Purchaser/ Buyer of property). The same can be viewed from the TRACES website (www.tdscpc.gov.in) or

b) Taxpayer can also click the option ‘View Acknowledgment’ hosted on the TIN website. Taxpayer needs to enter PAN of the Buyer and Seller, Total Payment and Assessment Year (as mentioned at the time of filing the Form 26QB) to retrieve the Acknowledgment Number.

4. What is Form 16B?

Form 16B is the TDS certificate to be issued by the deductor (Buyer of property) to the deductee (Seller of property) in respect of the taxes deducted and deposited into the Government Account.

5. From where will I get the Form 16B?

Form 16B will be available for download from the website of Centralized Processing Cell of TDS (CPC-TDS) www.tdscpc.gov.in

6. Can I make Cash/ Cheque payments for the TDS at Banks?

Buyer may approach any of the authorized Bank Branch to facilitate in making e-payment.

7. How will transactions of joint parties (more than one buyer/seller) be filed in Form 26QB?

Online statement cum challan Form/ Form 26QB is to be filled in by each buyer for unique buyer-seller combination for respective share. E.g. in case of one buyer and two sellers, two forms have to be filled in and for two buyers and two seller, four forms have to be filled in for respective property shares.

8. What is Fee in Form 26QB and when is it applicable?

As per section 234E of the IT Act, 1961 read with Rule 31A (4A) of IT rules, 1962, failure on the part of taxpayer to furnish challan-cum-statement in Form No. 26QB electronically within seven days from the end of the month in which the tax deduction is made will attract levy of fee to be paid by the buyer/transferee/payer.

9. How to make a tax payment towards Fee in Form 26QB?

Provision to enter Tax amount (comprising of basic tax, interest and fee) in Form 26QB is given in TIN website and Bank’s site.

10. I have entered the tax amount in Fee, I am unable to generate Form 16B from the TRACES website?

The TDS amount as per Form 26QB should be entered in the field ‘Basic Tax’ (Income Tax) on the Bank’s web-portal as TDS certificate (Form 16B) will be based on ‘Basic Tax’ (Income Tax) only.

11. What should I do if I have misplaced the Acknowledgment slip for payment through the Bank branches?

You may access the access link ‘View/Payment of TDS on property” on the TIN website. On entering the details as per the acknowledgment slip, you will be provided options to either Print the Acknowledgment Slip.

In case you desire to make an online payment, on the same screen option for Submit to the bank is provided wherein you have to select the Bank for payment. Then, You will be taken to the net banking login screen wherein you can make the payment online.

12. Is PAN and TAN mandatory for deducting TDS on a property?

Yes, PAN No of buyer and seller is mandatory for deducting and depositing TDS on a property. and on the other hand, TAN No of buyer and seller is not mandatory for deducting and depositing the TDS on a Property.

- Financial Year: What is the financial year in India

- What is TDS return? & How to file it online?

- TDS on Salary under TDS section 192 (updated)

- TDS rates section-wise for current F.Y. (updated)

- Pan Aadhar Link

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.

What is the TDS rate on selling a property in India? Medallion Mohali