GST return status checking is very important to know the honesty of the supplier of goods and services to you and others. You should check the status in both cases when you are a

- Registered person or

- Unregistered person

Contents of this post

How to check GST return status as a registered taxpayer?

As a registered taxpayer, you will receive an Application Reference Number (ARN) on the submission of the return. You can track the status of your application by tracking this ARN. To track return status, perform the following steps:

- First of all, Access the GST Portal or www.gst.gov.in URL. The GST Home page will display.

- Then Log in to the GST Portal with valid credentials.

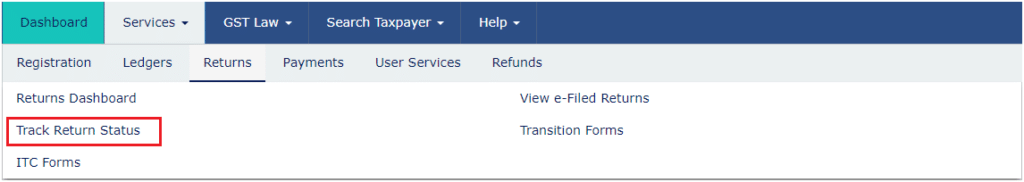

- After that, Click the Services > Returns> Track Return Status command.

In the Case of ARN

- First of all, select the ARN option

- In the ARN field, enter the ARN received on your e-mail address when you submitted the return.

- Then click the SEARCH button.

- Then the return Application status will display.

In Case of Return Filing Period

- First of all, select the return filing period option

- After that, Select the Submission Period of the return using the calendar.

- Then click the SEARCH button.

- Then the return Application status will display.

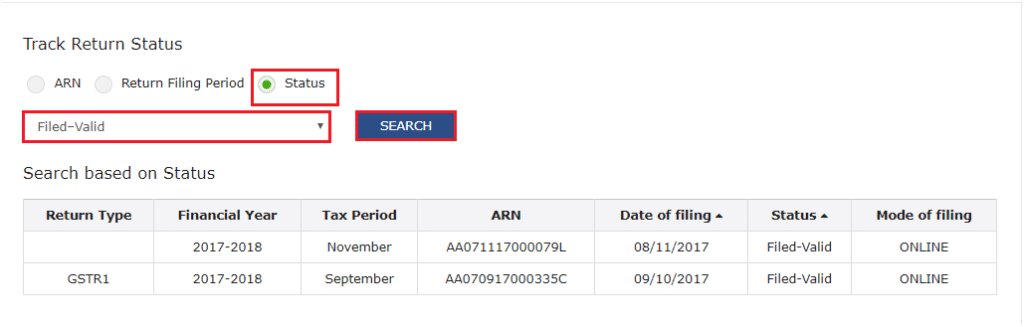

And In the Case of Status

- First of all, select the STATUS option

- After that, Select the Status of the return from the drop-down list.

- Then click the SEARCH button.

- Then the return Application status will display.

How to check the GST return status of your suppliers?

Sometimes, It is significant to check the GST return status of your supplier to ensure that the supplier is honest and better in GST compliance. You will have to perform the following steps to track your supplier return status.

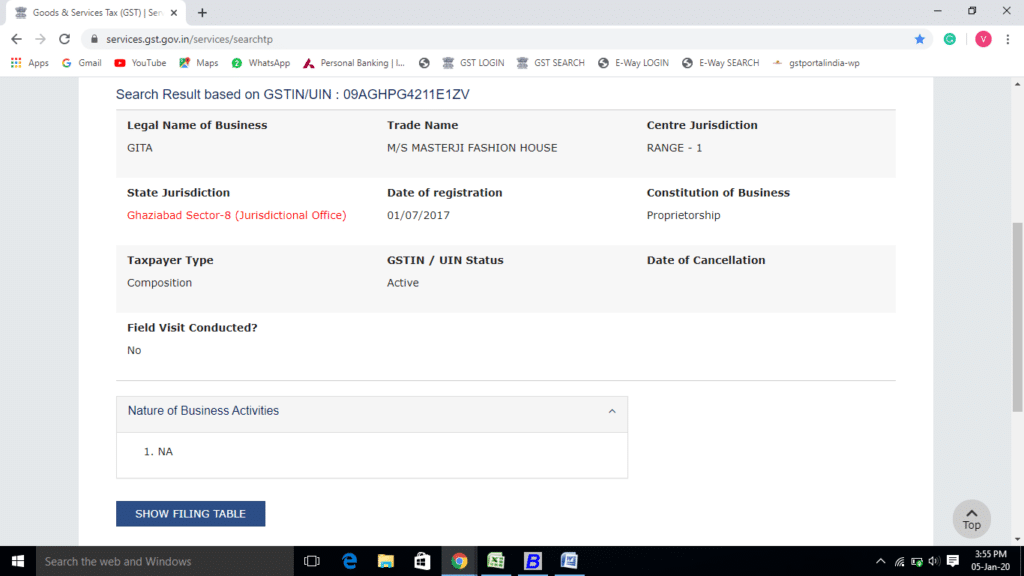

1. Firstly, Access the GST Portal or www.gst.gov.in URL. The GST Home page will display.

2. After that, click on the Search taxpayer > Search by GSTIN/UIN

3. Then enter the GSTIN OR UIN and

4. Type the characters you see in the image below

5. Then click the Search Button.

6. Now you will be able to see GSTIN Validity status details and

7. An option-show filing table

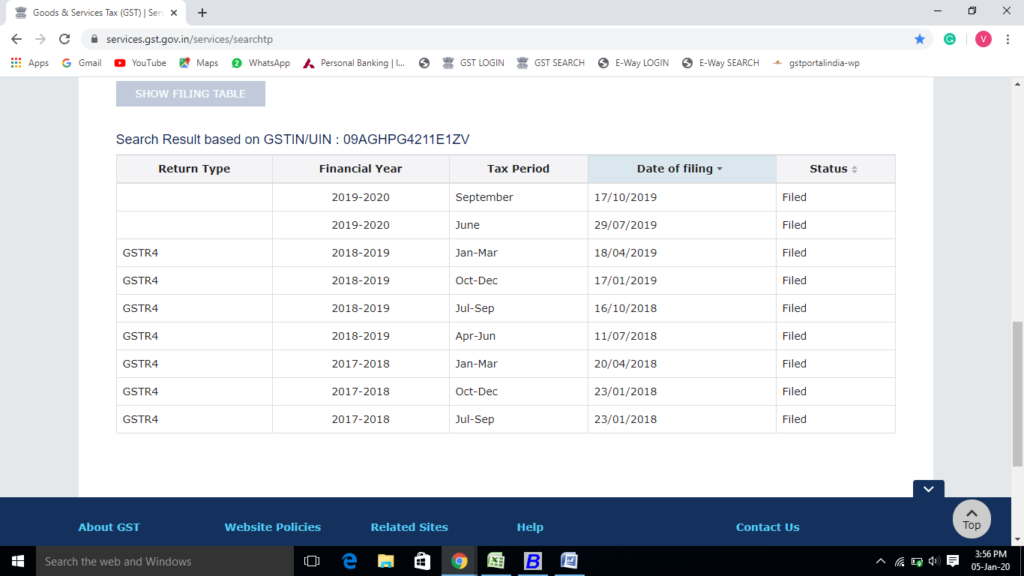

8. Just click on the show file table option.

9. Now you can see the return filing status of your supplier for the last six months on the basis of GSTIN/UIN.

10. And then you can check and confirm filed returns by your supplier.

What are the types of GST Return status?

These can be the types of the return status

1. TO BE FILED: Return due but not filed

2. SUBMITTED BUT NOT FILED: Return Validated but pending filing

3. FILED – VALID: Return Filed

4. FILED – INVALID: Return Filed but tax not paid or short paid

How to check GSTR 1 filing status?

It is very important to check the GSTR 1 return status of your supplier to ensure that the supplier is honest and good with GST compliances. You will have to perform the following steps to track your return status.

1. First of all, Access the GST Portal or www.gst.gov.in URL. The GST Home page will display.

2. After that, Click the Search taxpayer > Search by GSTIN/UIN

3. Then enter the GSTIN OR UIN and

4. Type the characters you see in the image below

5. Then click the Search Button.

6. Now you will be able to see GSTIN Validity status details and An option- to show the filing table

7. Just click on the show file table option

8. Now you can see the return filing status of your supplier for the last six months on the basis of GSTIN/UIN.

How to check GSTR 3B filing status?

It is very important to check the GSTR 3B return status of your supplier to ensure that the supplier is honest and good with GST compliances. You will have to perform the following steps to track your return status.

1. First of all, Access the GST Portal or www.gst.gov.in URL. The GST Home page will display.

2. After that, Click the Search taxpayer > Search by GSTIN/UIN

3. Then enter the GSTIN OR UIN and

4. Type the characters you see in the image below

5. Then click the Search Button.

6. Now you will be able to see GSTIN Validity status details and

7. An option- shows the filing table

8. Just click on the show file table option

9. Now you can see the return filing status of your supplier for the last six months on the basis of GSTIN/UIN.

How to view e-filed GST return online?

These are the simple steps to view your e-filed GST return online-

1. First of all, Access the GST Portal or www.gst.gov.in URL. The GST Home page will display.

2. Then Log in to the GST Portal with valid credentials.

3. After that, Click the Services > Returns>View e-filed returns.

4. Then Choose the Financial Year, Return Filing Period, and Return Type from the drop-down menu.

5. If the taxpayers file the Return Quarterly, choose Quarter from the list and If the taxpayers file the Return Monthly, choose Month from the list.

6. Then enter the Search button and you can view GST Return Status.

Faqs on GST return details

Further faqs on GST return Status-

1. Where can I check GSTR1 and 3b return details?

You can search your GST return status on the government’s official GST Portal.

2. Why should I check the return status?

We should check always the GST return filing status of us and others also due to prevent GST frauds from bad suppliers or for confirmation of whether GST return is filed or not.

3. Should I login to check the return status?

Yes, you want to see your GST return status. But in the case of other suppliers, you can check it without login. You can check out the steps given above for checking the status with and without login.

- GSTR 2B: Auto-drafted ITC Statement instructions

- How to file GSTR 9A? easy steps you should know?

- GSTR 9A: Definition, Eligibility & Due dates updated

- How to file GSTR 9?: Things You Didn’t Know

- GSTR 9: Definition, Eligibility & Due dates (updated)

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.