GST Portal login is mandatory for Taxpayers because of the higher use of GST Portal Services In India. There are many GST services available on the GST Portal That are mandatory to use for every taxpayer for example-

- New GST Registration with required documents

- GST Return filing

- GST payments

- Search GST taxpayer details

- GST offline tools

- GST amendments online

- And all other GST-related services.

Contents of this post

- How to log in to GST Portal for the first time?

- Should you change the username or password after the first login?

- How to search the GST Portal or GST official website to log in?

- What to do if I forget the username or password?

- Who can log in on the GST Portal?

- What are the tips for safe GST login?

- What are the facilities that can be used after GST login?

- What is the process of GST registration?

- How to login into the GST Portal as a registered taxpayer?

- Faqs on safe GST login

How to log in to GST Portal for the first time?

If you want to log in to GST Portal then, first of all, you will have to get GST registration when you are liable to Register.

After getting GST registration online, you will have to log in to the GST portal for the first time to use the GST Portal services continuously.

These are the steps to log in for the first time on the GST Portal-

- Firstly, go to the GST portal by searching on the Google related keywords, for example- GST login, GST Portal login

- Then on Portal, you will see below the login page the first-time login option as First-time login: If you are logging in for the first time, click here to log in.

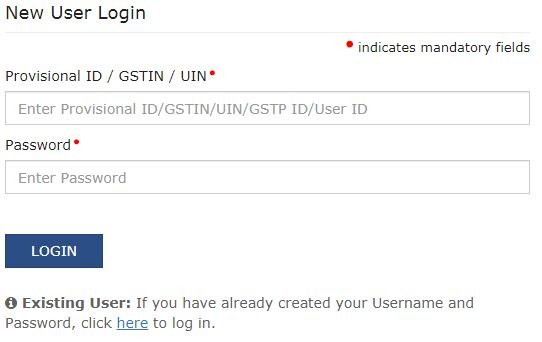

- Now click on the Here link option then you will see as below screen.

- Here for the new user login a provisional ID/ GSTIN/ UIN and password is mandatory to log in which you will get after getting the GST registration approval.

- The GST officer will provide a provisional ID/ GSTIN/ UIN and password to a new taxpayer by sending a message on the Registered mobile No or mail on the Registered mail ID.

- Here you will have to log in with that provisional ID/ GSTIN/ UIN (user name)and password.

- It is advised to change the user ID and password immediately after the first time login.

- GST portal will ask you to change the user name or password and then change it as per your choice.

- After that, you can use the GST portal at any time by logging in with your user ID and password.

Should you change the username or password after the first login?

Yes, It is necessary to change the username and password after the first login because of security reasons. After all, you can use the same username and password but it is not safe to log in. It is also advised by the GST Department to change immediately after the first login.

And according to me, you should change the username and password as you like it is simple and easy to change.

How to search the GST Portal or GST official website to log in?

Sometimes, as new users or old users, we find more difficulties in reaching the GST portal or GST official website for using the GST portal services.

If you are facing difficulties then don’t worry now use these important tips to search GST Portal on Google.

- Use the direct links to open the GST website which are https://services.gst.gov.in/ or https://www.gst.gov.in

- If you use daily GST Portal services then bookmark the official website in your Brower when you bookmark it you can open it directly from there.

- Sometimes, taxpayers use to search in Google Then how to confirm the official website so now you should check the website URL that should be Govt URL.

- If there is no Govt URL then do not try to log in with that website.

What to do if I forget the username or password?

Yes, you can get your forgotten name or password at any time so don’t worry if you forget your username or password.

Just use these tips to retrieve the username or password with the help of your

- Firstly, Just go to the login page on the GST Portal.

- Then check out the link of Forgot password or Forgot username.

- And just click on the provided link.

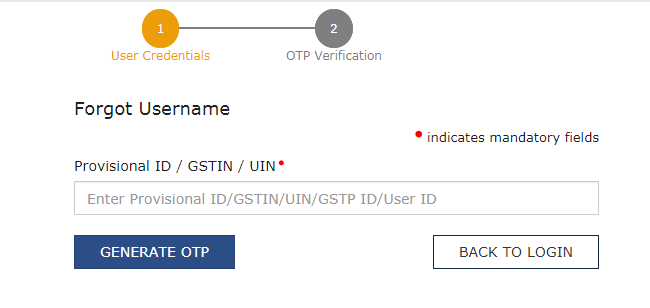

- When you click you will see this-

- Just enter anyone out of Provisional ID/ GSTIN/ UIN/ GSTP ID/ USER ID that you have.

- Then click on Generate OTP then an OTP will be sent to the registered mobile or email id.

- Now enter the OTP and submit.

- After that, you will get your username on your registered mail or mobile no and the same process will apply in case of password forgot.

Who can log in on the GST Portal?

Anyone can log in on GST Portal who has a login username or password. For that, you should be registered on the GST portal as

- Foreign Company

- Foreign Limited Liability Partnership

- Government Department

- Hindu Undivided Family

- Limited Liability Partnership

- Local Authority

- Partnership

- Private Limited Company

- Proprietorship

- Public Limited Company

- Public Sector Undertaking

- Society/ Trust/ Club/ AOP

- Statutory Body

- Unlimited Company

- GSTP and others.

If you are registered on the GST portal and do not have a username or password then you can’t log in.

You can not use the internal GST Portal facilities without a login but you can use so many helpful services on the GST portal without a login which are

- GST registration

- Download offline helping tools

- Search GST taxpayer details by GSTIN/ PAN NO

- Study the latest content

- Check out the latest Due Dates for Returns

- GST-related latest updates and amendments

- Can find a taxpayer

- Can watch the helping GST videos

What are the tips for safe GST login?

As a registered taxpayer, you should use safe log-in tips or processes. sometimes, the registered taxpayer or his employee uses to log in but they get so many problems in which unsafe content can be used.

So follow these tips to safe login

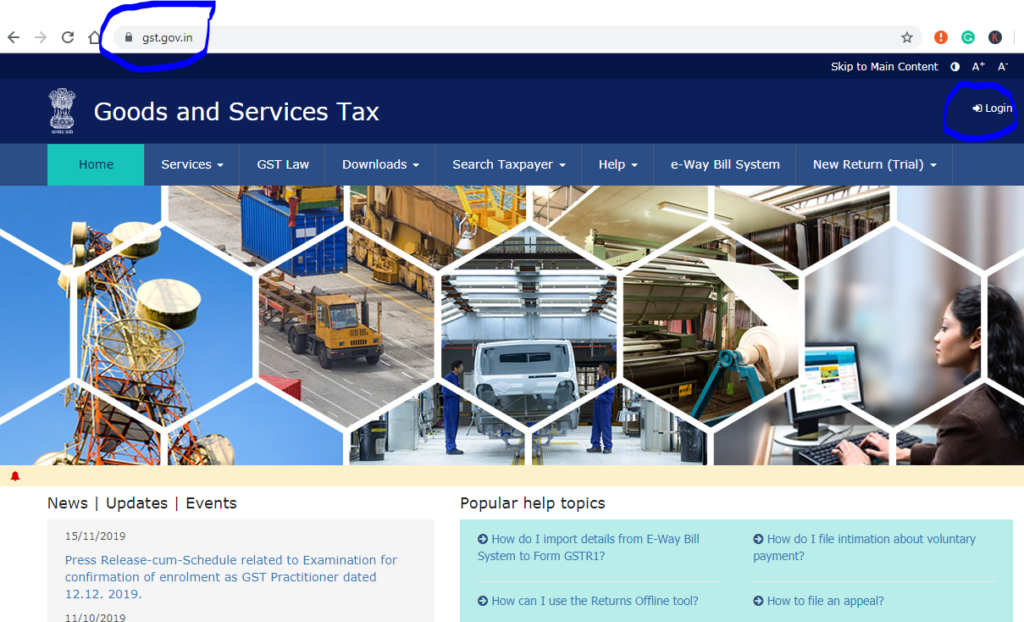

- First of all, search the official GST website which looks as below with the URL – https://www.gst.gov.in/

- After searching the official website just check out the govt URL or the above homepage screen.

- Then go to the login option and click after that a login page will open.

- Now you should use a valid login username or password to log in.

- Before login make sure that the login username or password is correct or noted.

- If the login username or password is correct then try to log in and if you have any confusion about login credentials then confirm first.

- If you enter the wrong username or password 3 times then the username will block and you will have to generate a new username or password.

- And if your login credentials are correct then your GST portal will open for use and now you can use the internal GST facilities.

What are the facilities that can be used after GST login?

The facilities that can be used after the login are available for the taxpayer who has become liable to pay GST tax.

When a taxpayer becomes liable to pay GST tax on the supply of goods and services to any customer then the taxpayer is liable to get GST registration online.

After getting GST registration he will get a username or password to use the GST portal services without login or after the login, he can able to use the facilities such as

Registration

- Application for Filing Clarifications

- Track Application Status

- Application to Opt for Composition Levy

- Application for Withdrawal from Composition Levy

- Stock intimation for opting for Composition Levy

- Amendment of Registration(Non-Core Fields)

- Amendment of Registration Core Fields

Ledgers view

- Electronic Cash Ledger

- Electronic Credit Ledger

- And Electronic Liability Register

- Payment towards Demand

Returns filing

- Returns Dashboard-to file GST returns

- New Return (Trial)

- Track Return Status

- View e-Filed Returns

- ITC Forms

- Transition Forms

- Annual returns

GST payment

- Create Challan

- Saved Challan

- Challan History

- Grievance against Payment(GST PMT-07)

Other user services

- My Saved Applications

- View My Submissions

- View Notices and Orders

- Download and View Certificates

- Search HSN / Service Classification Code

- Search Taxpayer Opted In / Out of Composition

- Holiday List

- Feedback

- Locate GST Practitioner (GSTP)

- Generate User Id for Advance Ruling

- Engage / Disengage GST Practitioner (GSTP)

Refund services

- Application for Refund

- My Saved/Filed Applications

- Track Application Status

What is the process of GST registration?

As Taxpayer Business Man, we should know how to apply online on GST portal India.

Because as a businessman, we are liable to pay tax on sales we are required to register ourselves on the GST portal.

So you are to follow these simple steps to register yourself on the GST portal-

- First of all, go to the GST portal site via the Google search engine.

- Then go to Services>Registration>New Registration>

- Fill in all required details and proceed

- Now you will get a TRN no for further form fill-up

- Then in the same way proceed through TRN no and fill in all required details as demanded in the GST registration

- After filling in all detail just verify and submit the form

- And you will get an ARN No for tracking

- you will get your registration no very soon if there is no alteration required.

How to login into the GST Portal as a registered taxpayer?

Firstly you will have to learn what is GST and GST portals and why you need them.

After understanding the word GST and web GST Portal further, we should know how to log in to the GST PORTAL.

So we can know it very fast with these all easy steps. Follow the below-given steps to log in:

- Firstly get your GST registration from any expert or you can register yourself for GST registration online.

- Go to Google search engine and search keyword GST PORTAL or www.gst.gov.in (direct login click here)

- Then click on the above link or the first link available on Google and you will go to the GST portal.

- After that register yourself if not registered and if you already registered then log in by clicking on the login button in the top right corner.

- As a registered taxpayer use the received login username or password to log in enter captcha no and finally click on the login button.

- At the last, you will see you are at your login portal where you can conduct all your GST activities.

As a result, we should be careful at the time of login to the GST portal.

Faqs on safe GST login

To keep your GST login safe, create a strong and unique password, avoid sharing it with others, enable two-factor authentication if available, and be cautious of phishing attempts.

If you forget your GST login password, you can reset it on the official GST portal by following the “Forgot Password” link and providing the necessary information for verification.

It’s not recommended to use public computers or shared networks for GST login as they may not be secure. Always use trusted and private devices when accessing your GST account.

If you receive any suspicious emails or messages claiming to be from GST authorities, do not click on any links or provide personal information. Report such incidents to the official GST support.

No, your GST login ID is generated during the registration process and cannot be changed. However, you can change your password for added security.

- How to login Udyam Registration Portal?

- Delhi EWS/DG Admission for 24-25, Eligibility, Dates

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.