27 GST state code is representing the GST state code for Maharashtra in India. 27 is the two-digit code. And It is used as the first two-digit in the GSTIN No of a taxpayer of Maharashtra. It is used for the identification of the state or UT.

For example– A Taxpayer who is doing business in Maharashtra and has a business place in Maharashtra. Now he will get a GSTIN No after GST Registration Online. Such as 27AACCF8045D1ZM, in this GSTIN No, you will see that the first two digits are representing Maharashtra. It means this GSTIN NO belongs to Maharashtra and has a business place or location in Maharashtra.

Contents of this post

What is GST State Code for Maharashtra?

GST State Code for Maharashtra is 27 and has values under the GST system in India. This is the first two digits of a GSTIN NO of a taxpayer belonging to Maharashtra. And having a place of business in Maharashtra.

| GST STATE CODE | STATE |

|---|---|

| 27 | Maharashtra |

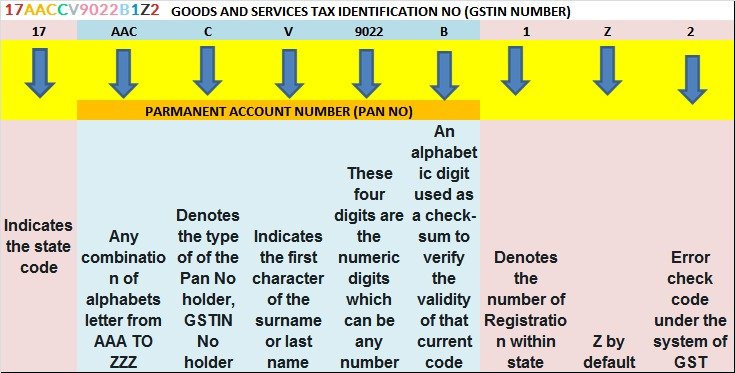

For the 27 GST State code example, check out the below image here first two digits indicate the state code of Meghalaya -17 and if you see 27 at the place of 17 then it will indicate the GST state code of Maharashtra as 27AACCV9022B1Z2.

27 GST code of which state?

- 27 GST State code belongs to Maharashtra in India.

- It will be available in GSTIN No of the GST taxpayer of Maharashtra only.

- 27 GST State code represents the first two digits in GSTIN No.

- It will not represent any other State because it belongs to Maharashtra

- you can identify the GSTIN No as belonging to Maharashtra if you will see the first two digits are 27.

Where can I find the GST code for Maharashtra?

You can find the GST state code for Maharashtra under the list of GST state codes which is available on GOOGLE or on the GST Portal. Because it is usable for the identification of the state of any GST taxpayer who is doing business in India.

We have also available a list of GST state codes. And you can use it for searching your GST state code just by visiting the list available below

| S.No | State Name | State GST Code |

|---|---|---|

| 1 | Jammu and Kashmir (UT) | 01 |

| 2 | Himachal Pradesh | 02 |

| 3 | Punjab | 03 |

| 4 | Chandigarh (UT) | 04 |

| 5 | Uttarakhand | 05 |

| 6 | Haryana | 06 |

| 7 | Delhi (UT) | 07 |

| 8 | Rajasthan | 08 |

| 9 | Uttar Pradesh | 09 |

| 10 | Bihar | 10 |

| 11 | Sikkim | 11 |

| 12 | Arunachal Pradesh | 12 |

| 13 | Nagaland | 13 |

| 14 | Manipur | 14 |

| 15 | Mizoram | 15 |

| 16 | Tripura | 16 |

| 17 | Meghalaya | 17 |

| 18 | Assam | 18 |

| 19 | West Bengal | 19 |

| 20 | Jharkhand | 20 |

| 21 | Orissa | 21 |

| 22 | Chhattisgarh | 22 |

| 23 | Madhya Pradesh | 23 |

| 24 | Gujarat | 24 |

| 25 | Daman and Diu | 25 |

| 26 | Dadra and Nagar Haveli & Daman and Diu (UT) | 26 |

| 27 | Maharashtra | 27 |

| 28 | Karnataka | 29 |

| 29 | Goa | 30 |

| 30 | Lakshadweep (UT) | 31 |

| 31 | Kerala | 32 |

| 32 | Tamilnadu | 33 |

| 33 | Puducherry (UT) | 34 |

| 34 | Andaman and Nicobar Islands (UT) | 35 |

| 35 | Telangana | 36 |

| 36 | Andhra Pradesh | 37 |

| 37 | Ladakh (UT) | 38 |

| 38 | Other Country | 97 |

What is the difference between the Maharashtra State code and the Maharashtra GST state code?

This is the difference between the Maharashtra state code and the Maharashtra GST state code-

| Maharashtra GST state code | Maharashtra State code |

|---|---|

| 27 | MH |

| Represents the first two digits of GSTIN No of Maharashtra | Represents a short form of Maharashtra |

| It is used in GSTIN No only for identification of the state or UT | It can be used anywhere in written or oral as a short form of Maharashtra |

Faqs on Maharashtra GST code

The GST code 27 represents Maharashtra in India.

The GST code 27 is used to identify businesses, taxpayers, and transactions associated with Maharashtra for Goods and Services Tax (GST) purposes. It helps in ensuring proper tax administration and compliance within the state.

A GST number represents a taxpayer of a state in India. So for example, A taxpayer Suny Gupta in Maharashtra has GST Number-27DKKPS2852A1ZM.

No, the 27 GST code specifically corresponds to Maharashtra. It should be used only for transactions occurring within the boundaries of Maharashtra.

It’s essential to use the correct GST state code for accurate reporting and compliance. If you use the GST code “27” for transactions outside Maharashtra, it may lead to incorrect tax calculations and non-compliance with GST regulations. It’s advisable to use the correct state code for the respective state where the transaction occurs.

It indicates the code of gst referencing a particular state in India. So 27 is the code of Maharashtra State for identifying a GSTIN no of Maharashtra.

- How to login Udyam Registration Portal?

- Delhi EWS/DG Admission for 24-25, Eligibility, Dates

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

- Stale cheque meaning, filling, example & benefits

- Self cheque filling, example, features & benefits

- Bankers cheque-One thing you should know

- Refer to Drawer (04-09) cheque return reasons

- Exceeds arrangement meaning for cheque bounce

- CHEQUE RETURN REASONS LIST IN BANKING

- EFFECTS NOT CLEARED; PRESENT AGAIN REASON (3)

- EXCEEDS ARRANGEMENT (2)- REASON OF CHEQUE RETURN

- Electoral Bond-definition, history, working, controversies & more

- IPO Registrar: A list of IPO registrars in India

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.