07 GST State Code for Delhi

07 GST state code is representing the GST state code for Delhi (UT) in India. It is a two-digit code. And It is used as the first two-digit in the GSTIN No of a taxpayer of Delhi. It is used for the identification of the state & UT.

For example– A Taxpayer who is doing business in Delhi and has a business place in Delhi. Now he will get a GSTIN No after GST Registration Online. Such as 07AACCF8045D1ZM, in this GSTIN No, you will see that the first two digits are representing Delhi. It means this GSTIN NO belongs to Delhi and has a business place or location in Delhi.

Contents of this post

What is GST State Code for Delhi?

GST State Code for Delhi is 07 and has values under the GST system in India. This is the first two digits of a GSTIN NO of a taxpayer belonging to Delhi. And having a place of business in Delhi.

| GST STATE CODE | STATE |

|---|---|

| 07 | DELHI |

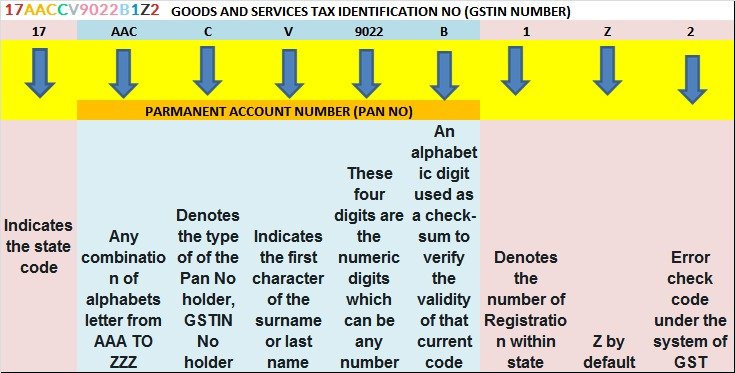

For the 07 GST State code example, check out the below image here first two digits indicate the state code of Meghalaya -17 and if you see 07 at the place of 17 then it will indicate the GST state code of Delhi as 07AACCV9022B1Z2.

07 GST code of which state?

- 07 GST State code India belongs to the Delhi capital of India.

- It will be available in GSTIN No of the GST taxpayer of Delhi only.

- 07 GST State code represents the first two digits in GSTIN No.

- It will not represent any other State because it belongs to Delhi.

- you can identify a GSTIN No is belongs to Delhi if you will see the first two digits are 07.

Where can I find the GST code for Delhi?

You can find the GST state code for Delhi under the list of GST state codes which is available on GOOGLE or on the GST Portal. Because it is usable for the identification of the state of any GST taxpayer who is doing business in India.

We have also available a list of GST state codes. And you can use it for searching your GST state code just by visiting the list available below

What is the difference between the Delhi State code and the Delhi GST state code?

This is the difference between the Delhi state code and the Delhi GST state code-

| Delhi GST state code | Delhi State code |

|---|---|

| 07 | DL |

| Represents the first two digits of GSTIN No of Delhi | Represents a short form of Delhi |

| It is used in GSTIN No only for identification of the state or UT | It can be used anywhere in written or oral as a short form of Delhi. |

Faqs on 07 GST code

The GST code “07” is used to identify businesses, taxpayers, and transactions associated with Delhi for Goods and Services Tax (GST) purposes. It helps in ensuring proper tax administration and compliance within the state.

No, the 07 GST code specifically corresponds to Delhi. It should be used only for transactions occurring within the boundaries of Delhi.

It’s essential to use the correct GST state code for accurate reporting and compliance. If you use the GST code “07” for transactions outside Delhi, it may lead to incorrect tax calculations and non-compliance with GST regulations. It’s advisable to use the correct state code for the respective state where the transaction occurs.

The GST code “07” represents Delhi in India.

It indicates the code of gst referencing a particular state in India. So 07 is the code of Delhi State for identifying a GSTIN no of Delhi.

A GST number represents a taxpayer of a state in India. So for example, A taxpayer Suny Gupta in Delhi has GST Number-07DDKPS2852A1ZM.

- How to login Udyam Registration Portal?

- Delhi EWS/DG Admission for 24-25, Eligibility, Dates

- Open cheque meaning, example, fillup, image & benefits

- Post dated cheque example, meaning, fillup & benefits

- Ante dated cheque meaning, example, filling & benefits

- Stale cheque meaning, filling, example & benefits

An Accountant, GSTP, GST blogger, Website Creator, SEO Builder & Co-founder of the website https://gstportalindia.in for the help of GST Taxpayers of India. Having a perfect accounting experience of more than 10 years in a Private Ltd Company.