29 GST state code is representing the GST state code for Karnataka in India. 29 is the two-digit code. And It is used as the first two-digit in the GSTIN No of a taxpayer of Karnataka. It is used for the identification of the state or UT.

For example– A Taxpayer who is doing business in Karnataka and has a business place in Karnataka. Now he will get a GSTIN No after GST Registration Online. Such as 29AACCF8045D1ZM, in this GSTIN No, you will see that the first two digits are representing Karnataka. It means this GSTIN NO belongs to Karnataka and has a business place or location in Karnataka.

Contents of this post

What is GST State Code for Karnataka?

GST State Code for Karnataka is 29 and has values under the GST system in India. This is the first two digits of a GSTIN NO of a taxpayer belonging to Karnataka. And having a place of business in Karnataka.

| GST STATE CODE | STATE |

|---|---|

| 29 | Karnataka |

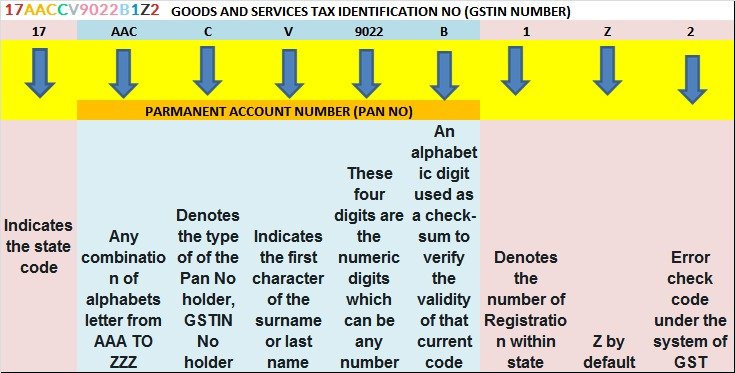

For the 29 GST State code example, check out the below image here first two digits indicate the state code of Meghalaya -17 and if you see 29 at the place of 17 then it will indicate the GST state code of Karnataka as 29AACCV9022B1Z2.